CONGRATS!

You've Just Taken the 1ST Step Towards...

Learning How I Can Help You Get Approved For...

HIGH-LIMIT Business Cards, Business Lines of Credit, Business Loans, and Vehicle Loans -

That Reports Under Your Business' EIN...

WITHOUT the fear of getting DENIED due to low credit scores, or a THIN Business Credit Profile

Get Approved For High-Limit Business Financing Such As...

Business Financing, Business Loans, Business Lines of Credit, Vehicle Financing, Trade & Vendor Credit

Scale Your Business Quickly...

With A Tradeline Anywhere From... $50k, $100k, $150k, $250k or $500k

Two Payment Options Available

Pay After It Posts

Upfront Payment

ACCESS HIGH-LIMIT FINANCING

STOP getting denied for financing, GAIN unlimited borrowing power, and

improve your chances of obtaining high-limit business financing in the future, by adding a PRIMARY BUSINESS TRADELINE

to obtain business loans, lines of credit, vehicle financing or other types of vendor and trade credit

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

START OBTAINING UNSECURED BUSINESS FUNDING

Your Success

in Business is Our

Business

Having access to money and credit for your business ultimately

determines your business’s success or failure, per the SBA. But

unfortunately, according to Enterprenuer.com, 90% of business

owners never have a funding blueprint in place in order to get access to working capital, and ironically about 90% of businesses in the United States that open will end up failing and closing their doors for good.

"The 5 BIGGEST Mistakes Business Owners Make...'s Bad Personal Credit, Not Incorporating Properly, Not Knowing Which Banks to Apply to, Not Knowing Which Products Work Best for The Company

BILL BRADFORD, THE BRADFORD METHOD - OWNER

Primary Installment Business Tradeline Pricing

All Primary Business Tradeline Orders Are a ONE-TIME PAYMENT and MUST Be Paid Upfront

$25,000 Tradeline

$1,000 Investment

Great For...

Business Expenses

Smaller Vehicles

Small Business Loans

Smaller Credit Cards

Smaller Lines of Credit

$50,000 Tradeline

$2,000 Investment

Great For...

Luxury Vehicles

Company Vans/Trucks

Medium Business Loans

Medium Credit Card Limits

Medium Lines of Credit

$100,000 Tradeline

$3,000 Investment

Great For...

Luxury Vehicles

Company Vans/Trucks

Larger Business Loans

Larger Credit Card Limits

Larger Lines of Credit

$250,000 Tradeline

$6,000 Investment

Great For...

Fleet of Vehicles

Larger Business Loans

Larger Business Lines of Credit

Residential Purchases

Investment Opportunities

Attention Business Owners...

Unlock New Revenue Streams and Empower Your Clients...By Adding A $25k-$500k Primary Business Tradeline

Become an Exclusive Affiliate Broker for High-Limit Business Tradelines

Are you looking for a game-changing opportunity to expand your services and boost your clients' success? Look no further!

We're offering select business owners the chance to become exclusive affiliate brokers for our high-limit business tradelines.

WHY YOU SHOULD JOIN

Diversify Your Income by adding a lucrative revenue stream to your existing business with minimal overhead, becoming a Hero to Your Clients, helping them supercharge their business credit profiles, opening doors to better financing options with no financial risk

BENEFITS FOR YOUR CLIENTS

Your Clients will have stronger Business Credit Profiles, after adding High-limit tradelines, which can significantly boost business credit scores, increasing their approval odds with a robust credit profile, to improving their chances of securing high-limit business funding.

WHO THIS PROGRAM IS FOR

Our Exclusive TBM Affiliate Program is for business owners that want to

revolutionize business credit building, with access to the tools to transform your clients' financial futures while growing your own business. It's a win-win opportunity you can't afford to miss.

Ready To Enroll Now?

We understand as Business Owners and Entrepreneurs that you want to make sure you're making the right "investment" for your business. So we still want to provide you with the opportunity to move forward, and enroll into our TBM Mentorship and Business Credit Academy Inner Circle...

for the low investment cost of $5,500.00.

Please note, we only provide the discount of the additional $1,500.00 off

for 1st Time Call Enrollments

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

About Your Advisors,

The Bradfords

Bill Bradford here, along with Maisha, my wife and business partner of 20 years. Both Maisha and I are from Las Vegas, NV with experience in Business Credit Enhancement, Funding and Financing.

Years ago, with the help of our Coach and Mentor, we were able to develop a METHOD to building business credit, quickly and with ease - that has allowed us to create several successful six-figure companies, by getting approved for HIGH-LIMIT Business Credit and Funding.

So our goal is to provide you with these same methods and stragtegies in order to get approved for HIGH-LIMIT Vehicle Loans, Business Loans, Business Lines of Credit and Business Credit Cards...under your Business' EIN - withouth the fear of being denied

So that you are able to "invest" it back into your business, generate more cash-flow and more business revenue.

Having the ability to do so, you will be able to create a legacy for yourself and your family, while building generational wealth.

GET READY TO TAKE YOUR BUSIENSS FUNDING JOURNEY TO THE NEXT LEVEL...

QUICk & EASY WAYS TO START BUILDING BUSINESS CREDIT

FAST & WITH EASE

High-limit business tradelines act as a financial resume for your company.

They tell potential creditors that your business has a history of handling credit responsibly, making you a more attractive and less risky candidate for various forms of Business Credit and Funding . This can open doors to better financial opportunities, ultimately supporting your business's growth and success.

Along with a Properly Structured Business, and a "Robust" and Strong Business Credit Profile.. You'll NEVER have to worry about being denied again...

"The Key to Unlocking Unlimited Business Credit & Funding Opportunties is... High-Limit Business Tradelines"

BUSINESS CREDIT CARDS

High-limit tradelines show that other companies trust your business with substantial credit. This track record makes credit card issuers more likely to approve your application and offer higher limits, giving you more purchasing power for your business needs.

BUSINESS LOANS/ LINES

Lenders view high-limit tradelines as a sign of financial responsibility. It's like having a glowing letter of recommendation from other creditors. This positive history can lead to better loan terms, higher amounts, and lower interest rates, helping your business grow more affordably.

VEHICLE LOANS

When applying for vehicle loans under your business profile, high-limit tradelines demonstrate your company's ability to manage significant financial commitments. This can streamline the approval process and potentially result in more favorable terms, allowing you to acquire necessary vehicles without straining your business's cash flow.

Ready To Enroll Now?

We understand as Business Owners and Entrepreneurs that you want to make sure you're making the right "investment" for your business. So we still want to provide you with the opportunity to move forward, and enroll into our TBM Mentorship and Business Credit Academy Inner Circle...

for the low investment cost of $5,500.00.

Please note, we only provide the discount of the additional $1,500.00 off

for 1st Time Call Enrollments

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

INTRODUCING

PERSONAL Primary Tradelines

All PERSONAL Primary Tradeline Orders Are A ONE-TIME PAYMENT and Must Be Paid Upfront

Reports to: Equifax & Experian

Reports within 30-45 Business Days

(NO CPN'S ACCEPTED)

Requirements:

Name

Address

Full Social Security Number (copy not required - only the full number)

Date of Birth

Contact Number

Front & Back Color Copy of Identification Document

Auto Tradelines:

Backdated: 4 Years

$50,000 Tradeline: $1,750

$75,000 Tradeline: $2,500

$100,000 Tradeline: $4,000

Credit Card Tradelines:

Backdated: 2 Years w/ 10% DTC

$10,000 : $1,000

$15,000: $1,500

$25,000: $2,500

Introducing our TBM Funding Resources

Unlock your business's financial potential with our trio of powerful products.

NO PG Sam's Club Card Course

$47

Unlock up to $20,000 in unsecured credit for your business! Our course guides you step-by-step to obtain credit cards that report directly to your business credit profile. Learn insider tips to maximize approval odds.

Business Credit Vendors List

$147

Accelerate your business credit journey with our curated list of 200+ vetted vendors. Save countless hours and resources by accessing pre-screened companies that report to business credit bureaus. Fast-track your way to a robust business credit profile.

NO PG Vehicle Financing Course

$97

Drive your business forward! Discover how to secure vehicle financing that reports under your business credit profile. Our comprehensive course reveals strategies to get approved for vehicles while building your business credit simultaneously.

OUR SUCCESSFUL BUSINESS CREDIT BUILDING CLIENTS

Sandra L, 28

Logistics Owner

My husband and I have owned a trucking business for over 5 years. We wanted to expand our business, and get more trucks on the road, but hadn't been able to get approved for any financing, because we only had a few business tradelines reporting. It wasn't until we heard about T.B.M., that we contacted them, and they helped us with adding Business Tradelines in a short period of time. After that we were approved for vehicle financing, a few business loans, and lines of credit to have an entire fleet of trucks, that travel nationwide

David O, 45

PROJECT MANAGER

"I've been in real estate for years, but I always hit a wall when it came to expanding my portfolio. Banks would look at my business credit and offer peanuts, forcing me to dip into personal savings or miss out on golden opportunities. Then I discovered [Your Company Name]'s primary business tradelines, and it was like someone flipped a switch.

Within months of adding one of their tradelines, I applied for funding and nearly fell out of my chair when I saw the approval amount. It was more than triple what I used to qualify for!

Tony W., 39

LAWNCARE BUSINESS OWNER

“I wanted to start my lawn service business with both of sons, but I was having trouble getting approved for financing. After being turned down by a bunch of banks, I learned that they were checking my business credit reports, and that I didn't have enough business credit. A month later I found out about The Bradford Method, and they helped me with adding Primary Business Tradelines to my business profile. They posted fast and the process was very easy! Now I am able to get equipment, hire other employees, and can expand my business further"

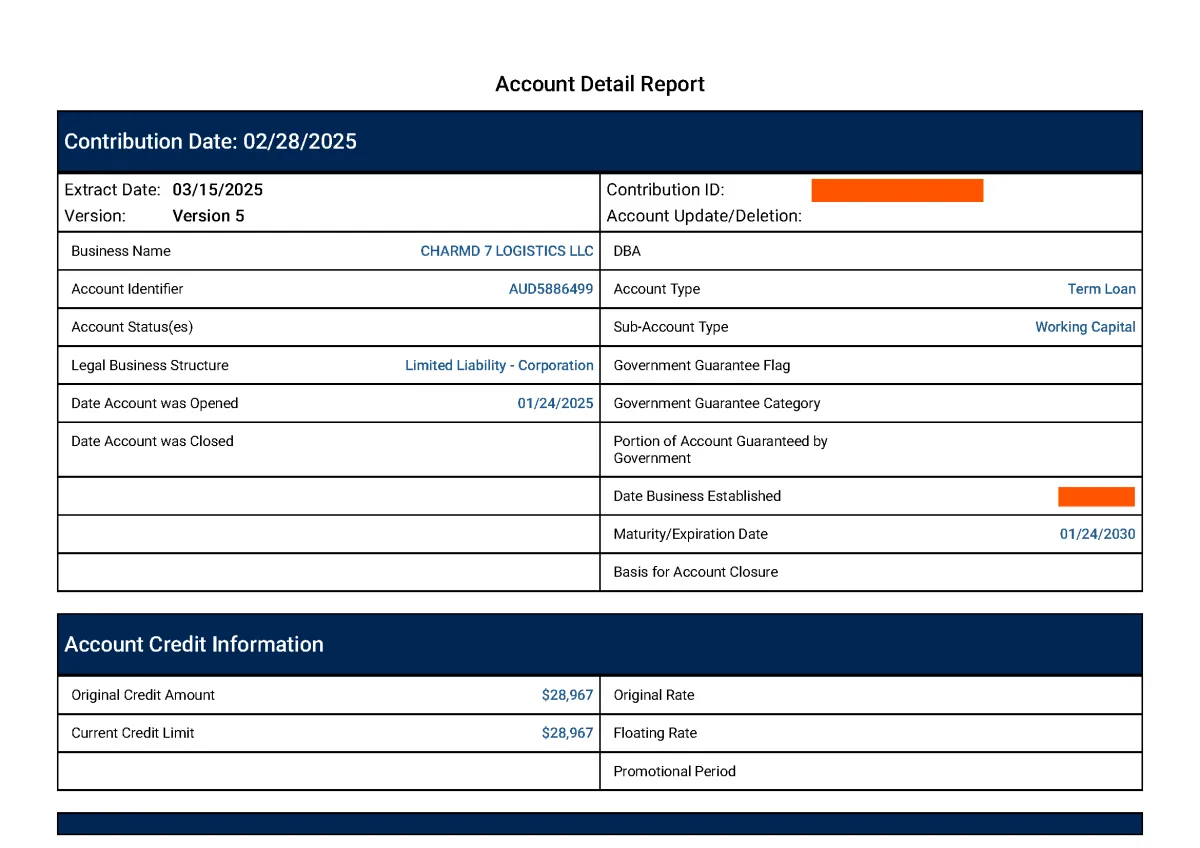

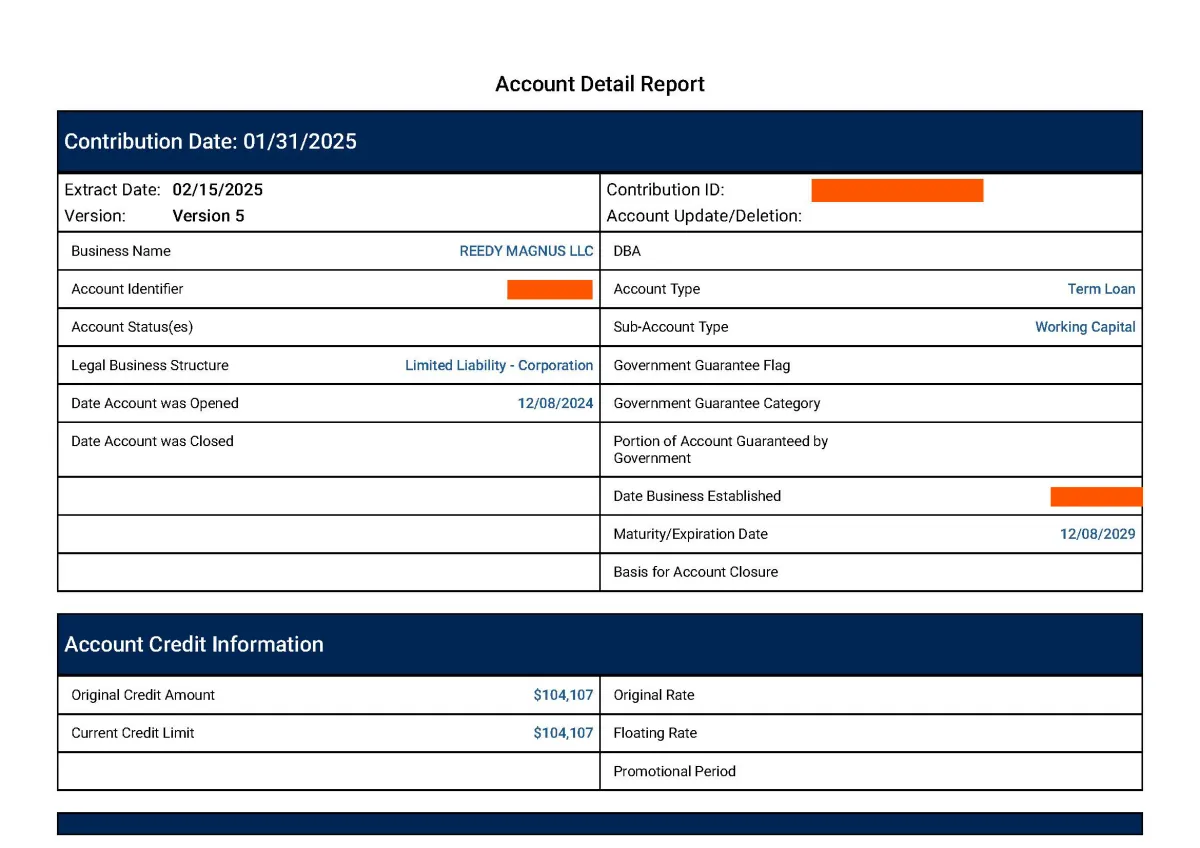

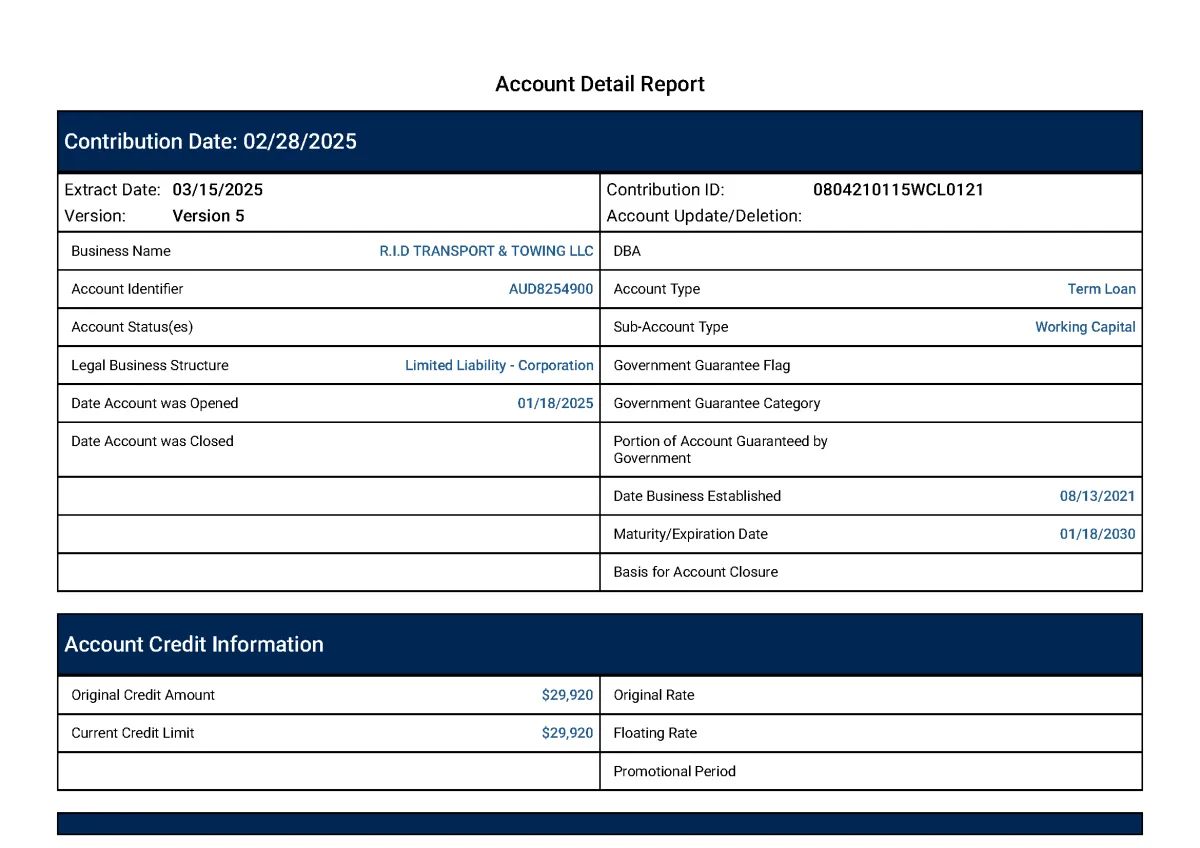

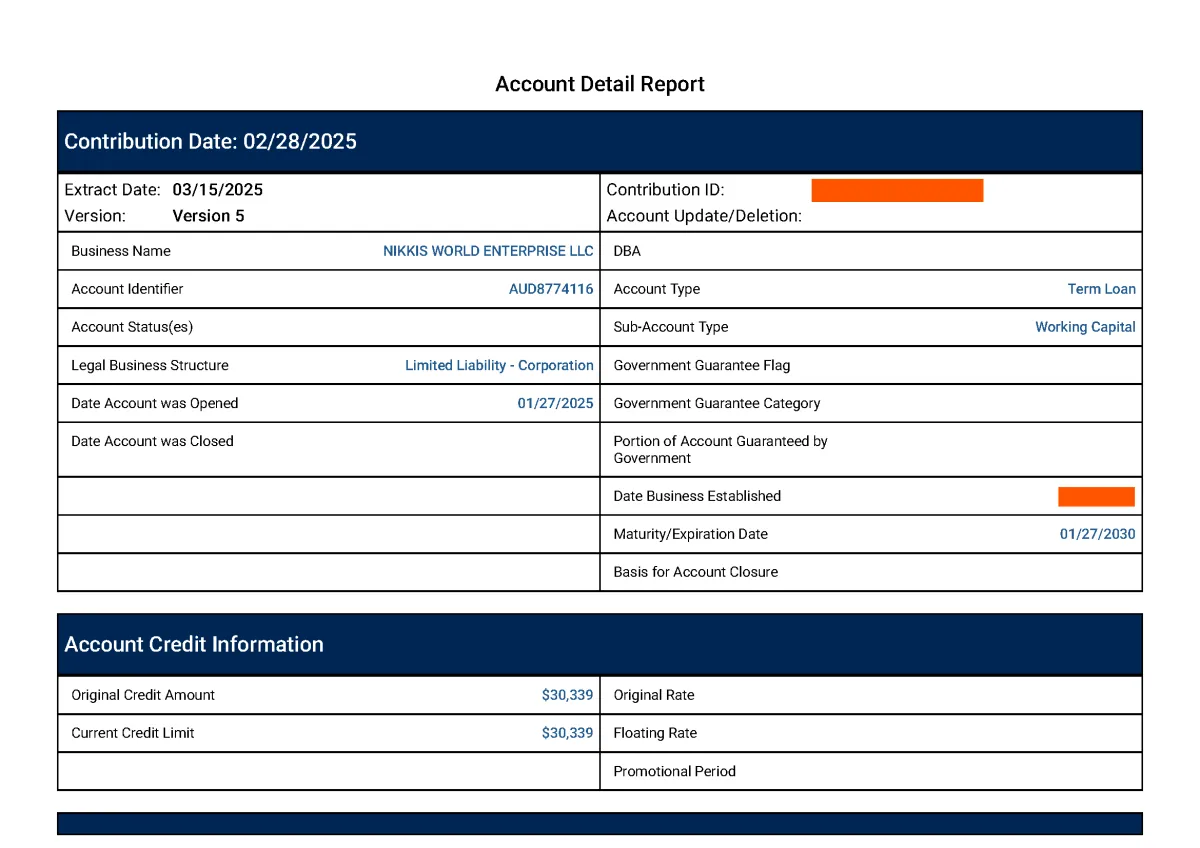

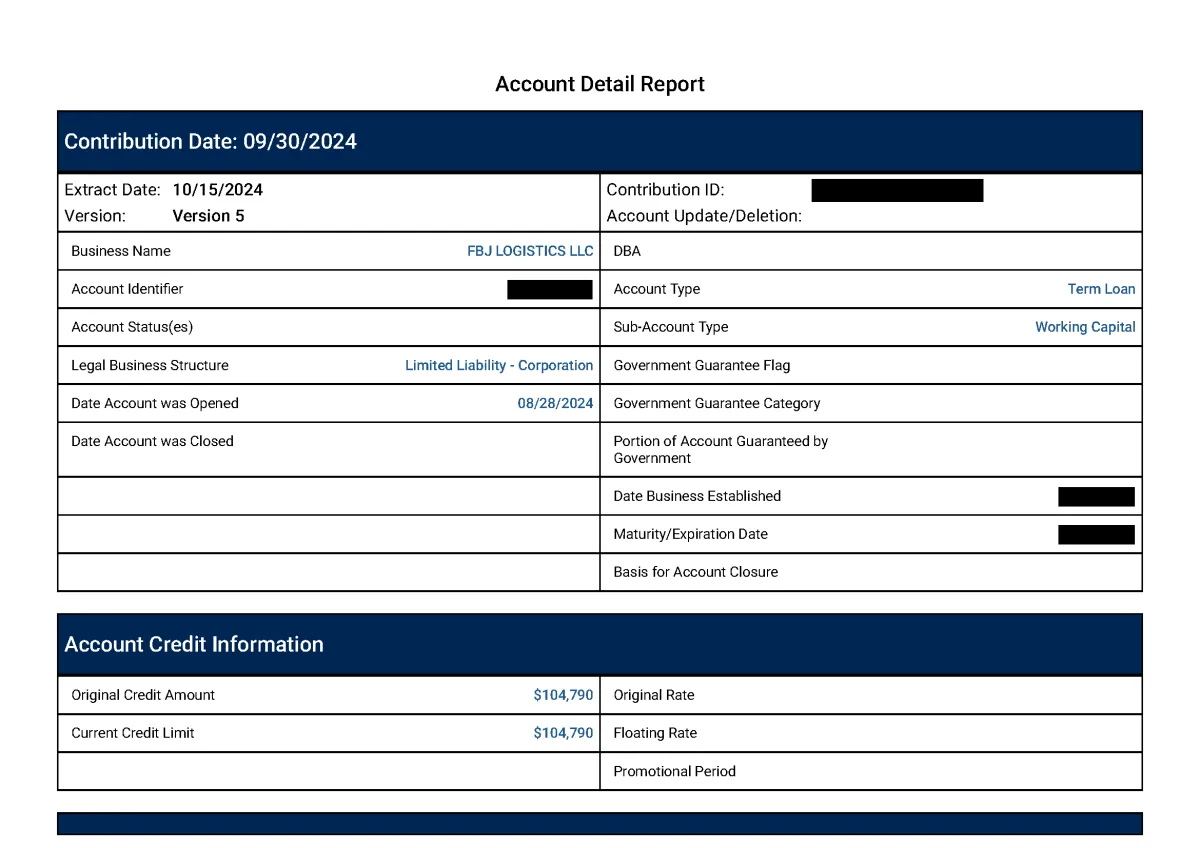

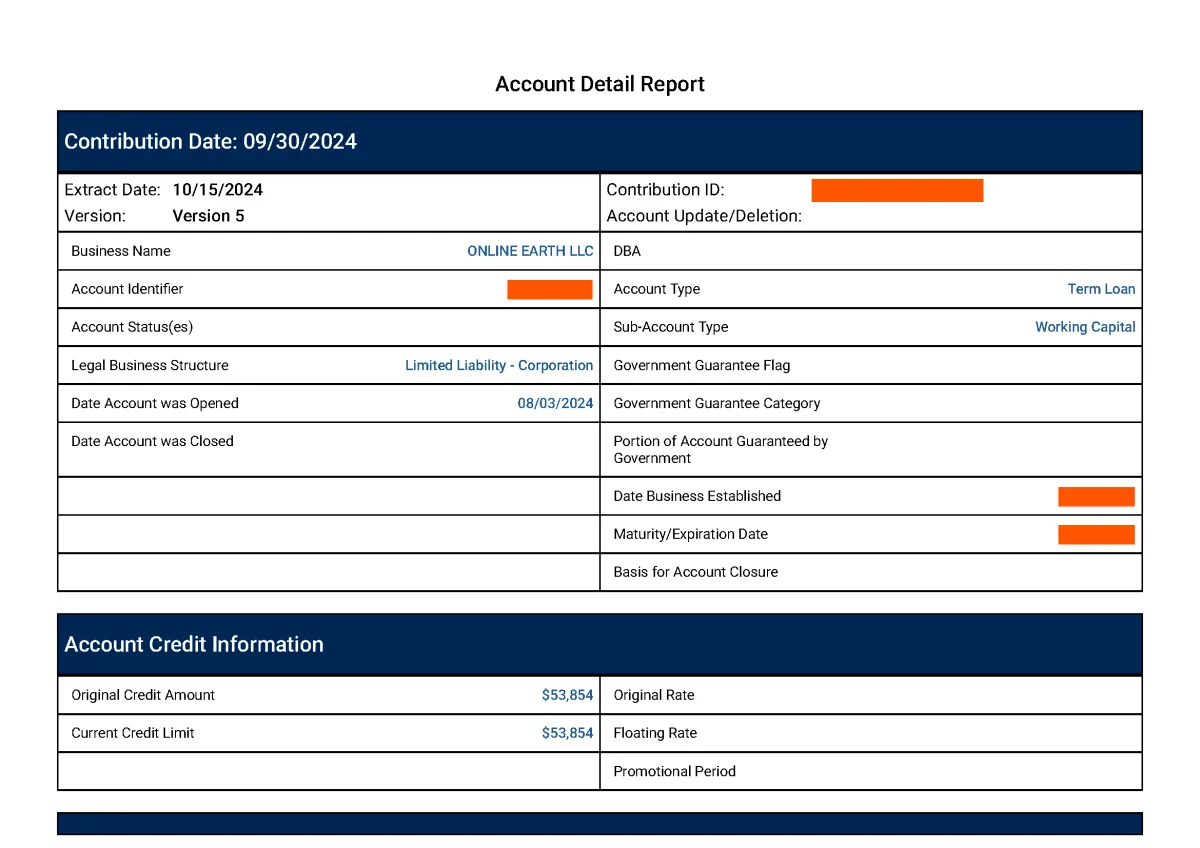

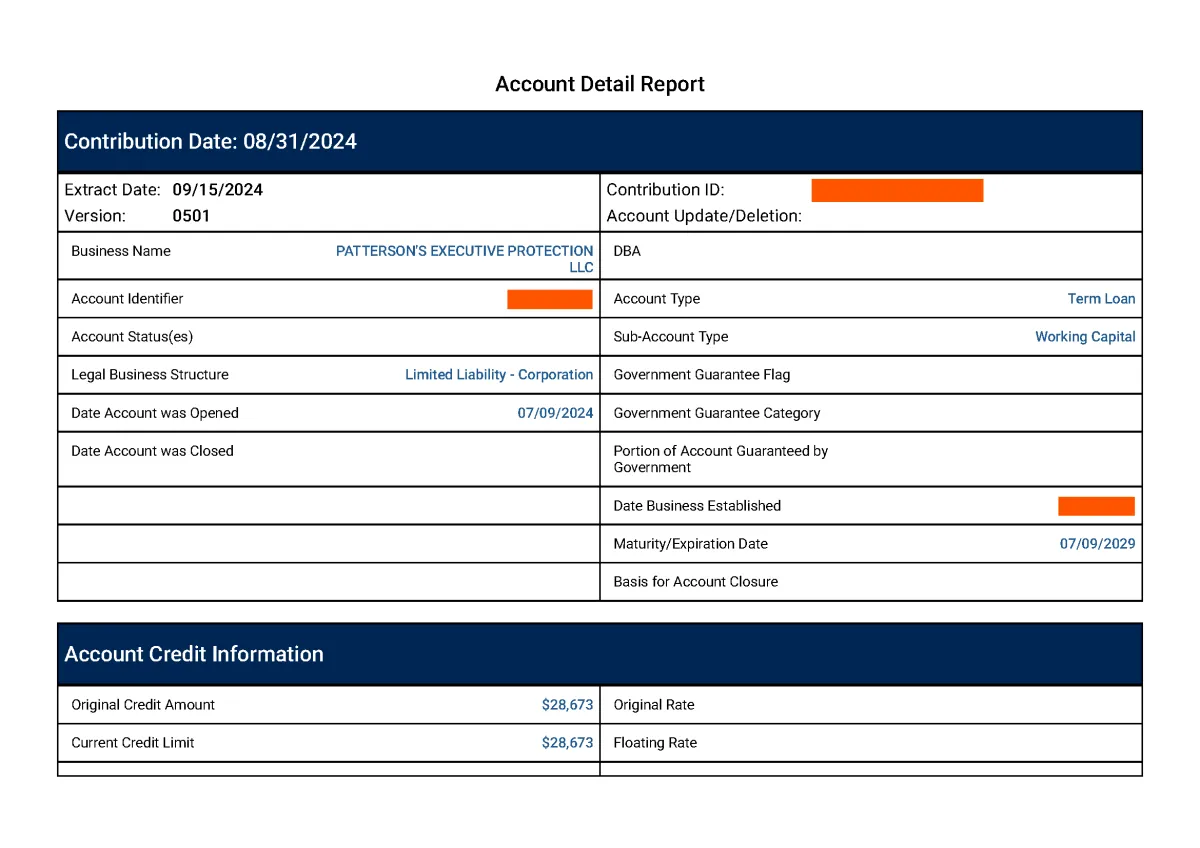

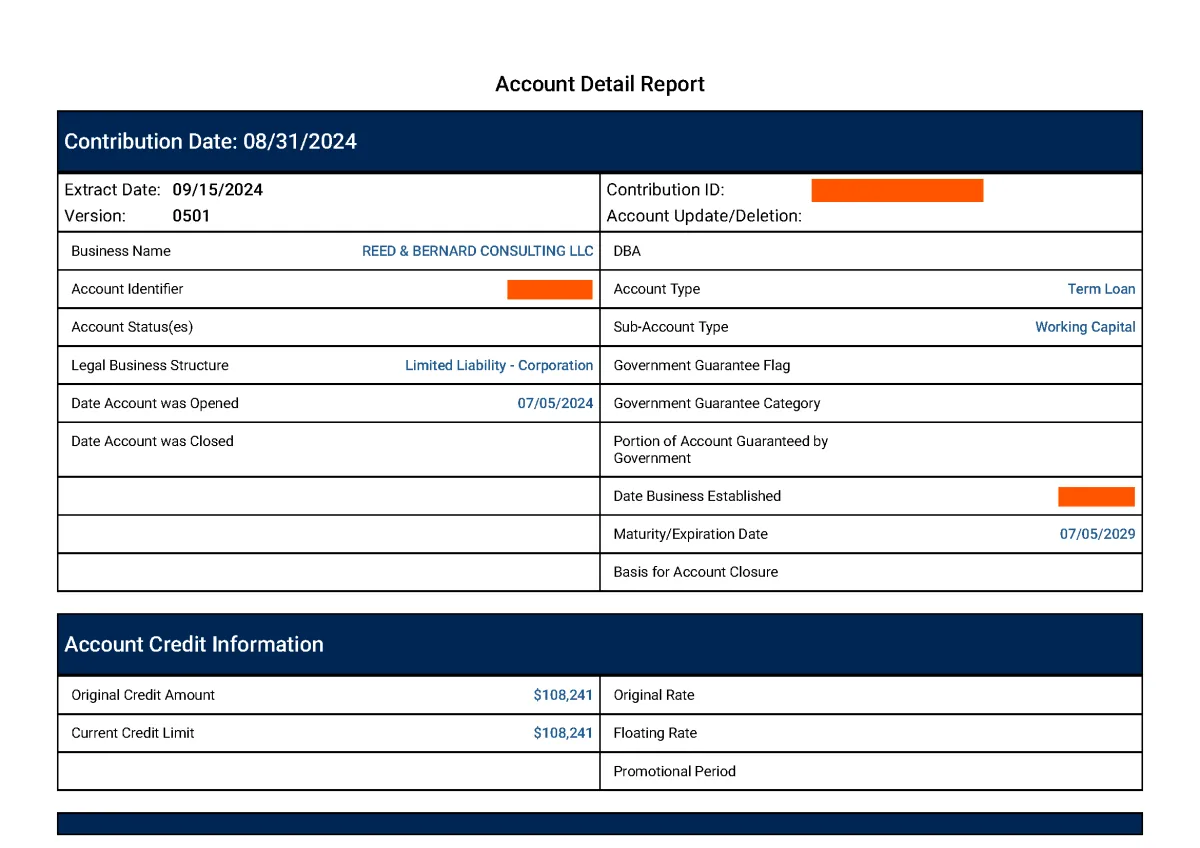

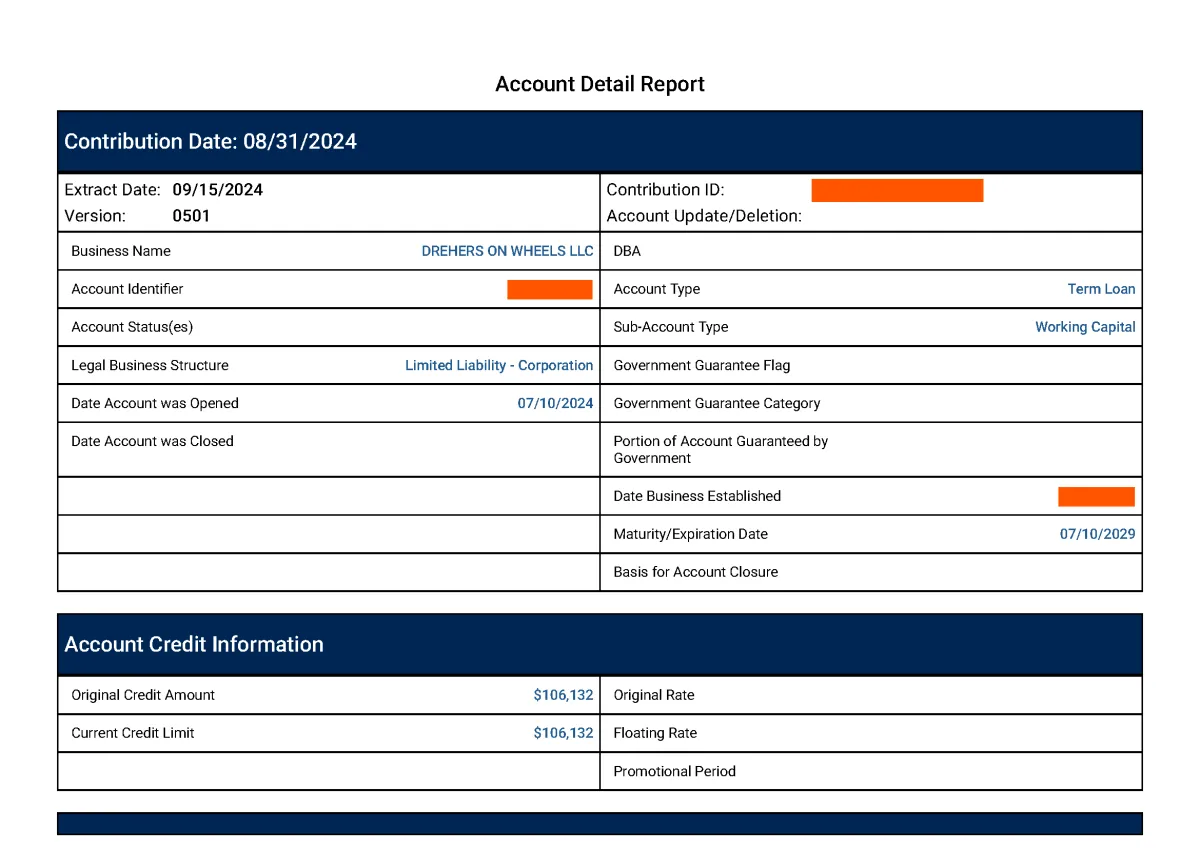

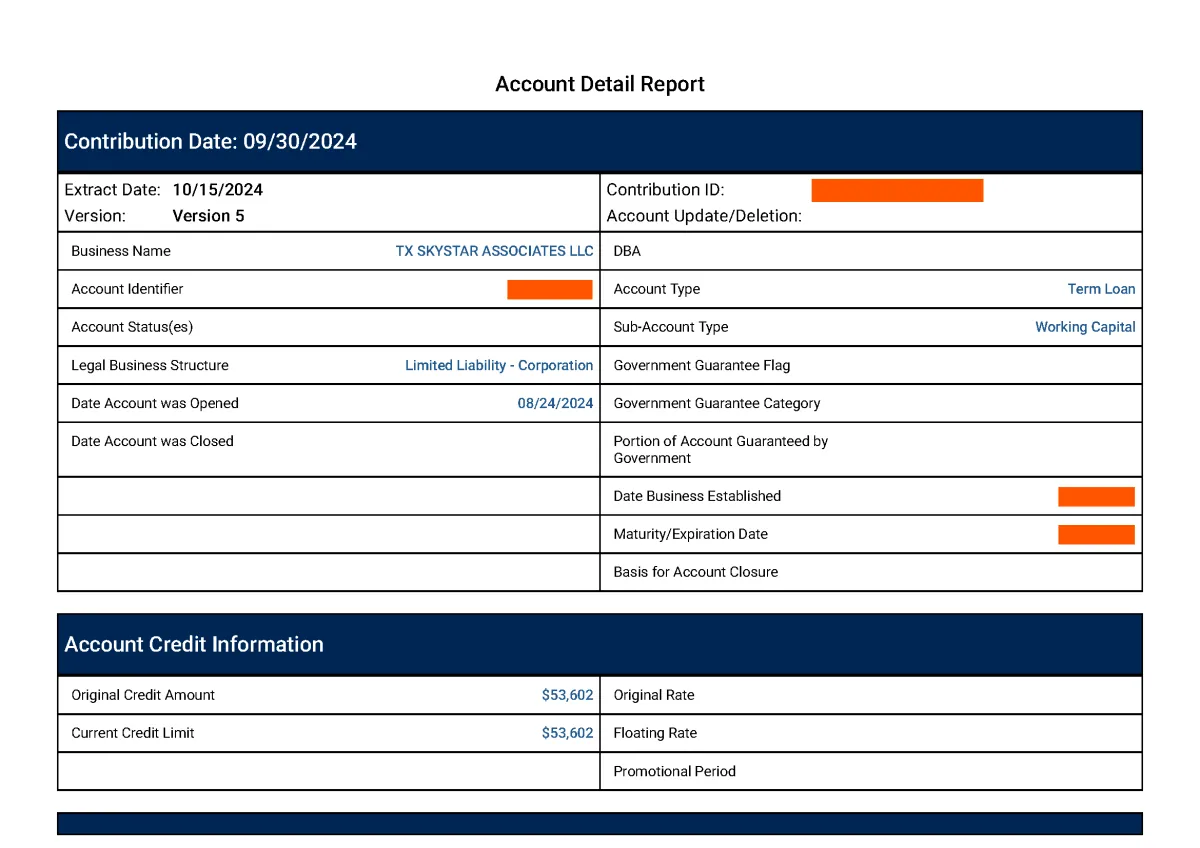

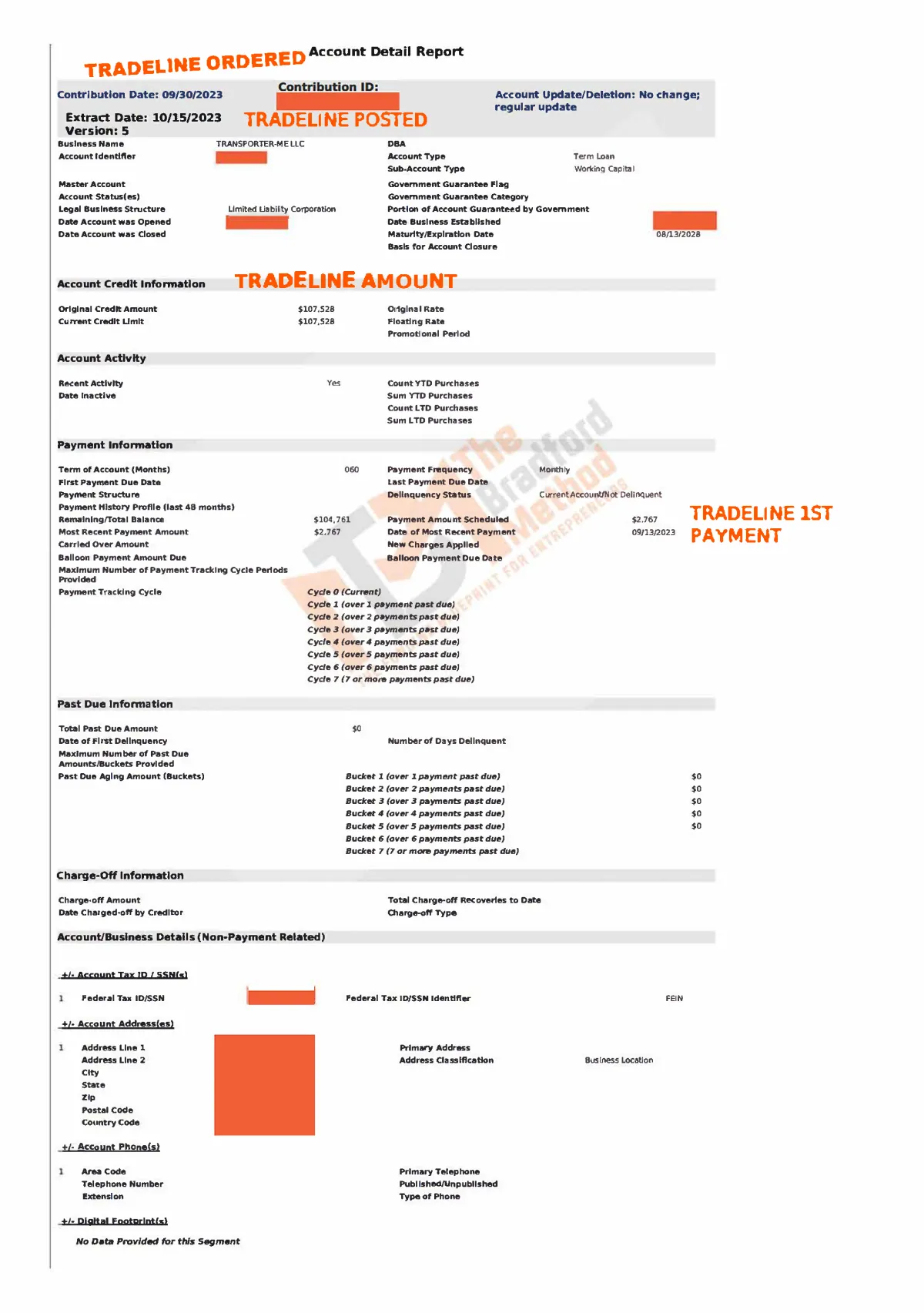

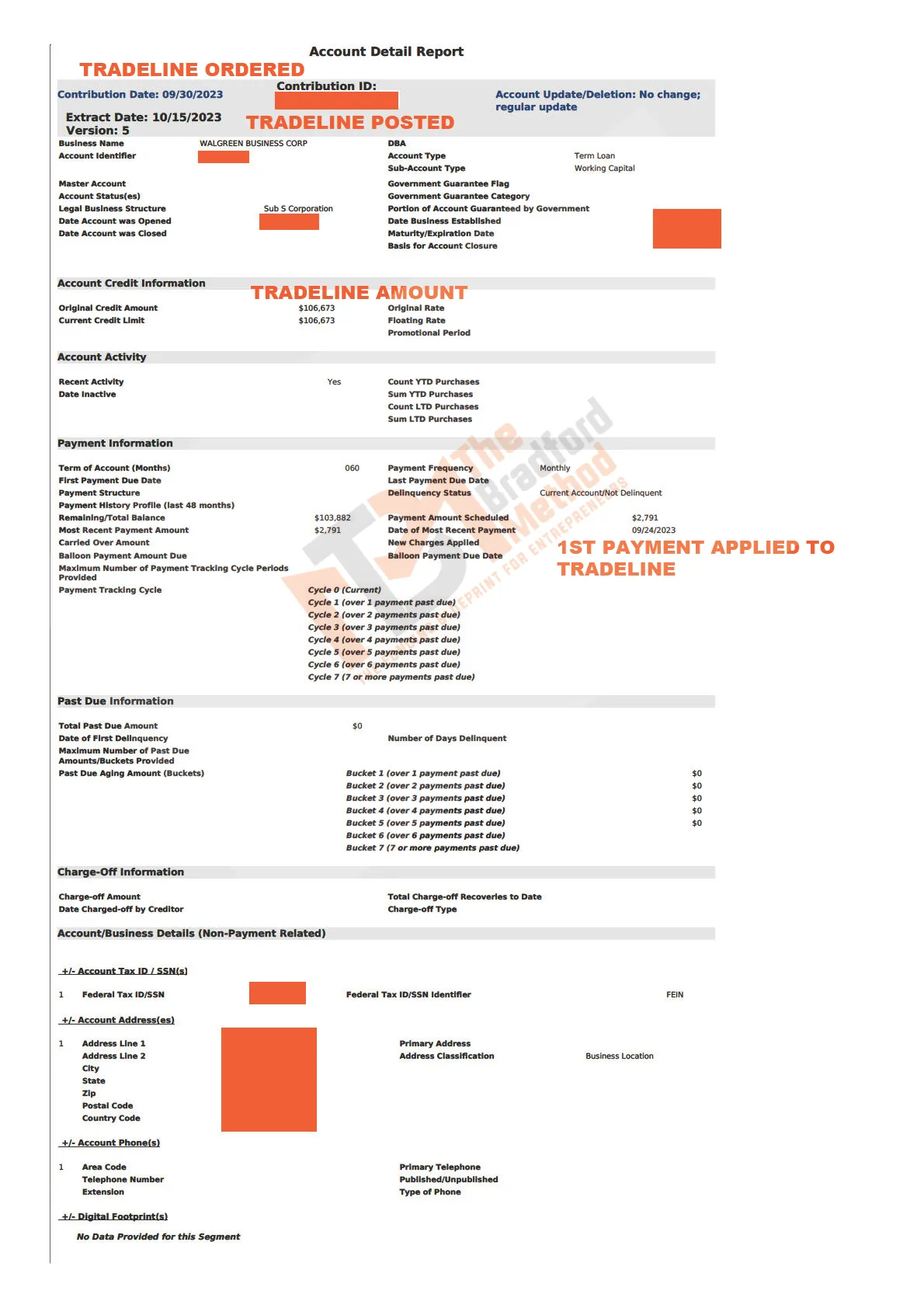

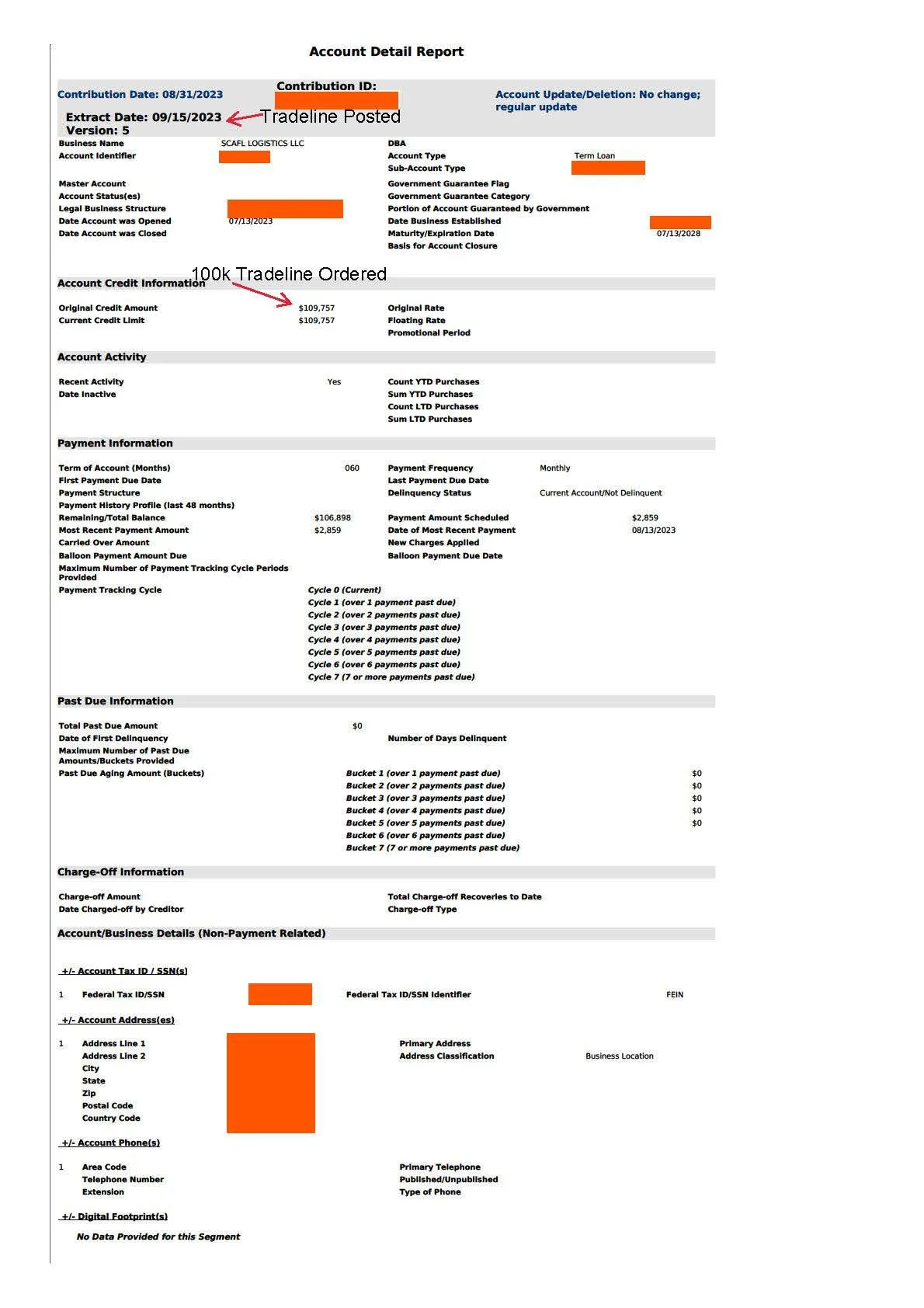

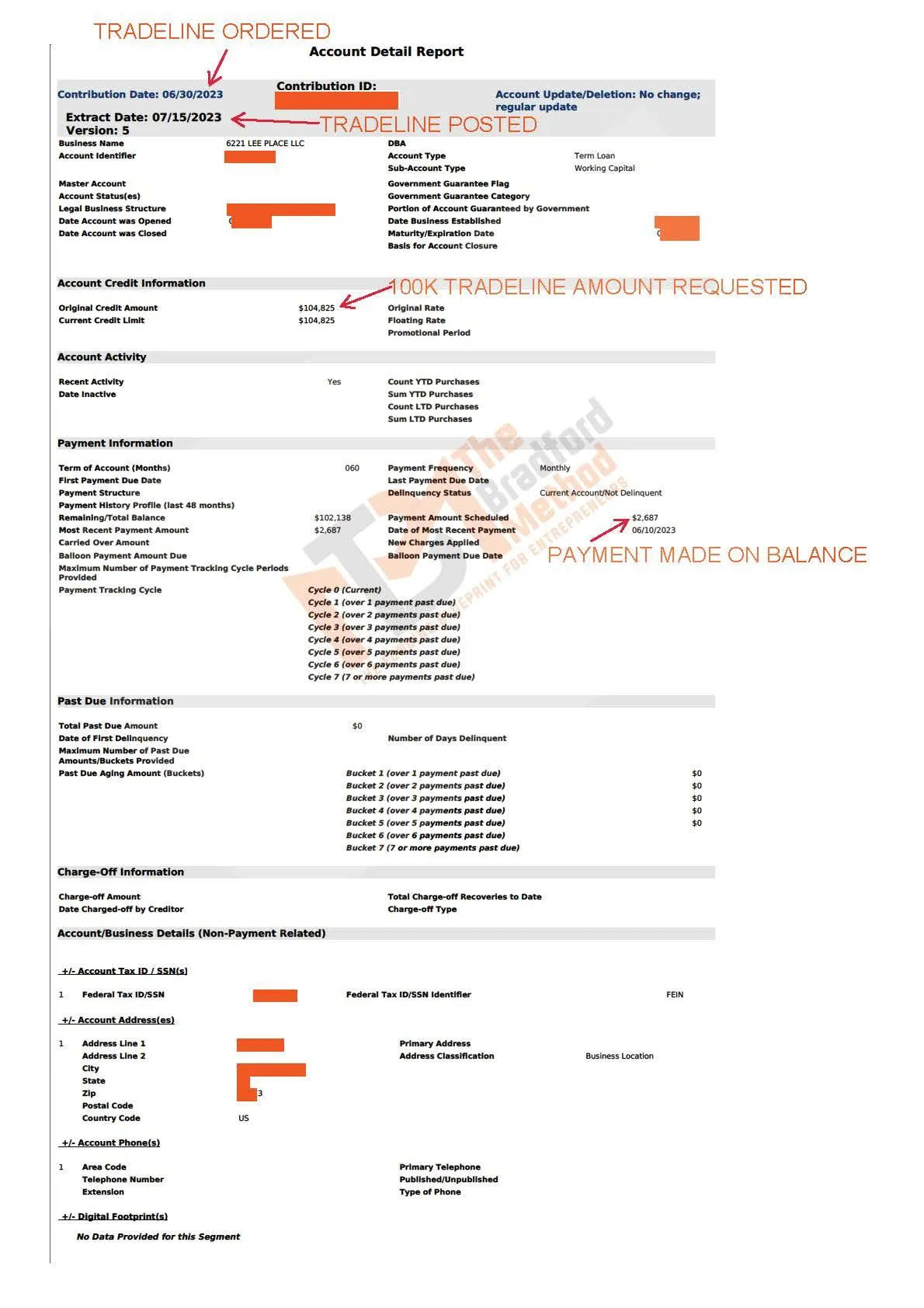

OUR RECENT SUCCESSFUL TRADELINE POSTINGS

Primary Installment Business Tradeline Overview

Business Entity

Business Structure / Entity MUST be an LLC,

S-Corporation or C-Corporation

Business Requirements

Business must be 7 months or older, for a high-limit primary business tradeline, and active with the Secretary of State with all fees paid

Credit Reporting

Business tradelines report to Experian Business & Commercial Credit, as well as the Small Business Financial Exchange

Tradeline Posting

Business Tradelines post on time, within 30 business days to the business credit profile and business credit reporting agencies Experian and S.B.F.E.

And Don't Just Take Our Word For How Successful We've Been...

Check Out The Tradelines That Have Posted For Some Of Our Clients

Testimonials

“I wanted to start my lawn service business with both of sons, but I was having trouble getting approved for financing. After being turned down by a bunch of banks, I learned that they were checking my busines credit reports, and that I didn't have enough business credit. A month later I found out about The Bradford Method, and they helped me with adding Primary Business Tradelines to my business profile. They posted fast and the process was very easy! Now I am able to get equipment, hire other employees, and can expand my business further"

Jose Q.

“My husband and I have owned a trucking business for over 5 years. We wanted to expand our business, and get more trucks on the road, but hadn't been able to get approved for any financing, because we only had a few business tradelines reporting. It wasn't until we heard about T.B.M., that we contacted them, and they hlelped us with adding Business Tradelines in a short period of time. After that we were approved for vehicle financing, a few business loans, and lines of credit to have an entire fleet of trucks, that travel nationwide.“

Loretta W.

Want More Proof of How We Help Our Clients Take Their Business To The Next Level...

Check Out Our Recent Primary Business Tradeline Postings

RECENT CASE STUDIES

Our Latest Success Stories

Don't Just Take Our Word For It... Listen To What Some of Our Past Customers Have Said About Our Funding Blue Print

Let us share a quick story with you.... not too long ago we attended a Business Credit & Funding Convention. We were there to learn more about how we can assist business owners and entrepreneurs with getting closer to their financial goals much sooner. It was at the convention where one of our past clients recognized us, and shared his journey of obtaining unsecured business funding to start and scale his businesses.

Below you will hear about how Josh had his own Real Estate Business, and needed more capital to invest into his portfolio, by purchasing more properties. After Josh reached out to us, we were able to assist him with a customized funding blueprint, where as of today he has obtained almost $300,000 in unsecured business funding.

Hey, It's Bill Bradford here, and along with Maisha, my wife and business partner of 20 years. Both Maisha and I are from Las Vegas, NV with experience in

Business Credit and Funding.

Years ago, with the help of our Coach and Funding Advisors, we were able to develop a system along with a Business Credit & Funding Blueprint called "The Bradford Method", and created two successful six-figure companies, by establishing

obtaining Unsecured Business Credit & Funding

Now using "The Bradford Method", we're showing other Entpreneurs and Business Owners get access to working capital for unlimited borrowing power.

THE FUNDING BLUEPRINT FOR ENTREPRENEURS

Business Credit Articles

Dun & Bradstreet / Paydex Score

HAPPY CLIENTS

3 Business Credit Myths

PROJECTS FINISHED

BUSINESS FINANCING DEMYSTIFIED

Do you want to start or grow your business, but can’t get a business loan? Our Funding Blueprint shows you how to obtain loans and creditlines that you can qualify for now, even without walking into a bank

CHOOSE YOUR PRICING PLAN

Basic

Monthly Package

$$$

Finance

Risk Management

Audit & Accounting

Marketing

Advanced

Monthly Package

$$$

Business Plan

Marketing Research

Expenses Analysis

Strategy Ideas

Deluxe

Monthly Package

$$$

Business Consulting

Marketing Plan and Strategy

Audit & Accounting

Law Assistance

OUR TEAM

Meet Your Business Credit Advisors

John Doe

John Doe

John Doe

Testimonials

“My business was started in 2013. At the time, we had severe cash flow issues and had to look at all options. I was in the Real Estate Industry, which I learned was h"high risk". Bill and Maisha showed me how to properly structure my business and I was then able to obtain a line of credit of $85K.

Jenny Q.

“Working with Bill and Maisha has been effortless and efficient. When I needed help, The Bradford Method worked around the clock to ensure I was able to make payroll and bring on new sales. They’ve alleviated the stress helping me get financing and funding for my business. “

Qwanda w.

Frequently Ask Question

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Get In Touch

Email: [email protected]

Address

Office: Las Vegas, NV

Assistance Hours

Mon – Fri 8:00am – 5:00pm

Sunday – CLOSED

Office: Las Vegas, NV

Frequently Asked Questions

Do I Have to Make More Than One Payment

There is a ONE-TIME, upfront payment for all of the TBM Primary Business Tradelines.

What Is Business Credit

Business tradelines establish permanent positive credit history to a business. Many companies rely on business credit to build the foundation of their business. Business tradelines provide the information banks use to determine whether or not to lend and how much.

What Are the Advantages of Adding Business Tradelines

Establishing positive business credit makes it much easier to get approval for a business loan, business vehicle loans or even an equipment line of credit. In addition, business tradelines can also help you get approved of larger amounts of funding. Potential lenders always request business credit reports in the same way they request personal credit reports

What Business Credit Bureaus Do the Tradelines Report To?

Our Primary Business Tradelines Report to S.B.F.E. (small business financial exchange) and Experian Business Commercial Credit. You can purchase reports from DnB, NAV and Equifax to see the Tradeline reporting.

When Does the Tradeline Post?

The Tradeline will post on your business credit profile within 30 BUSINESS days from the date your order was accepted.

Do You Offer Backdated Business Tradelines

No, we do not offer backdated tradelines. Our Primary Business Tradelines report as a new, open and active installment account to your business credit profile. We will establish successful monthly payments, on your behalf for up to 1 1/2 years.

Can I Purchase More Than One Tradeline at a Time?

Yes, you can which we will discuss further during your Tradeline Discovery Call, where we could possibly customize a Tradeline Package for you and your business.

How Will I Know My Tradeline Has Posted?

Once your Tradeline has posted, we will provide you with a copy of the S.B.F.E business report. You will also be provided with a link to Experian Business Credit Reports, where you can order an additional business credit report for $49.99

How Will My Primary Business Tradeline Report?

Your Primary Business Tradeline will report as a new, open and active account that reports to your business credit profile permanently

Will Tradelines Guarantee Me Funding?

We are not able to guarantee funding for you or your company because you have added a Primary Business Tradeline. Our Tradelines are customized to assist you and your business with getting approved for higher limits and better rates... showing credibility to banks and lenders. We always recommend you have one of the 3 "C's" of Cash-flow, Collateral or Credit as well, which will make your journey to obtaining financing much smoother.

Will Having a Balance Reporting on My Business Profile Keep Me from Getting Funding?

When we post the Tradeline to your business profile, there will be one payment already applied to the balance. Over a period of 90 days, we will pay down the balance by 75%. The remaining balance will be paid off over a period of 1 1/2 years.

Do You Offer Business Funding Assistance?

Yes, we provide Business Funding Assistance, however, because we customize each Business Owners Funding Blueprint, details can only be discussed during a Tradeline Discovery Call.

Do You Offer Any Other Business Services

Yes, we offer other TBM Business Services and Resources, however, they will only be discussed during your Tradeline Discover Call.