Watch Our Business Tradeline Overview...

To help your clients AVOID

Ever Getting Denied Again...

and INCREASE your client's odds of Getting Approved for... Vehicle Loans, Real Estate Deals, Business Loans, Lines of Credit and

Business Credit Cards

by adding a HIGH-IMPACT

Primary Business Tradeline – to their

LLC, C-Corp, or S-Corp.

The key to unlocking unlimited financial opportunities

Offer Real Business Tradelines...

and Help Your Clients Get Approved for

HIGH-LIMIT Funding!

Become a Business Tradeline Broker...

In order to help your clients build Fundable Business Credit Profiles, that Lenders Trust.

Next, Watch the Video Below

Become an Exclusive Affiliate Broker for High-Limit Business Tradelines

Are you looking for a game-changing opportunity to expand your services and boost your clients' success? Look no further!

We're offering select business owners the chance to become exclusive affiliate brokers for our high-limit business tradelines.

WHY YOU SHOULD JOIN

Join a results-driven broker network built for professionals serious about helping business owners get funded. Our system is turnkey, profitable, and proven to help your clients build strong business credit profiles that attract real approvals. Best of all, you’ll unlock a brand-new stream of income by offering a high-demand service that creates real results — without having to do the heavy lifting.

DEDICATED TRADELINE PROCESSOR

Every broker gets a personal tradeline processor to manage client onboarding, fulfillment, and reporting — so you can focus on growing your business while we handle the backend. Your processor ensures every order is accurate, on time, and professionally managed.

This saves you hours of admin work and gives you a seamless experience from start to finish.

FUNDING RESOURCE HUB

Gain access to shelf corps, credit repair, personal tradelines, and our vetted bank relationship managers — everything you need to help your clients get financed, all in one place. These add-on services position you as the solution provider, making you the go-to expert in your clients’ funding journey. Then with our bank contacts you can fast-track approvals when your clients are ready.

Ready To Enroll Now?

We understand as Business Owners and Entrepreneurs that you want to make sure you're making the right "investment" for your business. So we still want to provide you with the opportunity to move forward, and enroll into our TBM Mentorship and Business Credit Academy Inner Circle...

for the low investment cost of $5,500.00.

Please note, we only provide the discount of the additional $1,500.00 off

for 1st Time Call Enrollments

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

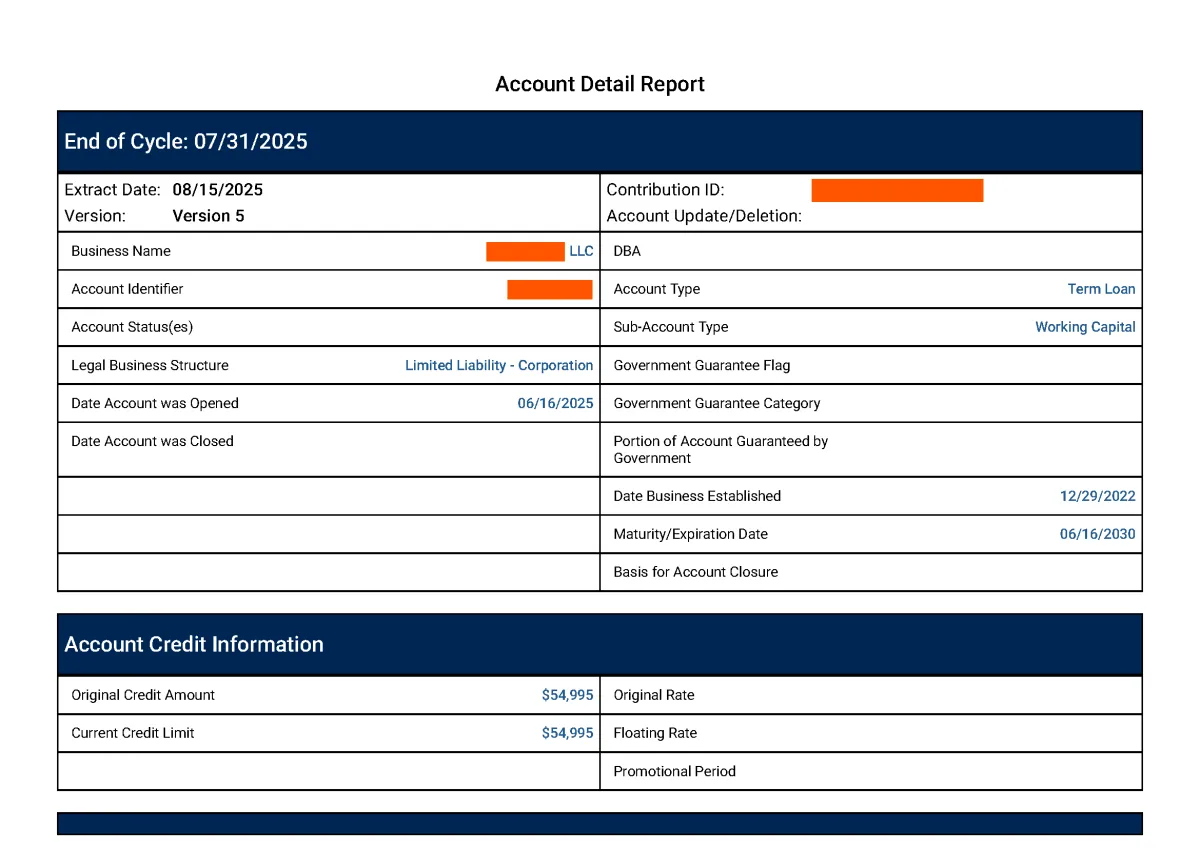

Primary Installment Business Tradeline Overview

Business Entity

All client's Business Structure / Entity MUST be an LLC, S-Corporation or C-Corporation

(NO SOLE-PROPS)

Business Requirements

Business must be 7 months or older, for a high-limit primary business tradeline, and active with the Secretary of State with all fees paid

Tradeline Broker Resller Info

As a Business Tradeline Broker reselling our Primary Business Tradelines, you deal directly with your clients. All information will be completely white-label.

Credit Reporting

Business tradelines report to the most important business credit bureaus such as Experian Business & Commercial Credit, as well as the Small Business Financial Exchange. A copy of the S.B.F.E report will be sent directly to Broker.

Tradeline Posting

Order Deadline: the 12th

All business tradelines post between 20th-22nd

Broker Requirements

There is NO FEE to become an Exclusive Broker, and we do NOT offer or provide a commission

Our Business Tradelines CANNOT go on the Personal Credit Profile

Primary Business Tradeline Offers

All Primary Business Tradeline Orders are a One-Time Payment and Must Be Paid Upfront

Payment Methods Accepted: Zelle or Cash App ONLY

$25,000

Broker Wholesale Price: $750

(Usual Tradeline Price: $1,000)

(Discounted by: $250)

Great For...

Qualify for Starter Business Credit Cards

Work Van or Small Business Vehicle

Approved for Store Cards & Net Accounts

Start Stacking Credit Lines

Credibility W/O Years in Business

$50,000

Broker Wholesale Price: $1,500

(Usual Tradeline Price:$2,000)

(Discounted by: $500)

Great For...

Approved for $25K–$75K business credit cards

Approved for Entry-level business loans

Office equipment or a small fleet vehicle

Higher Tier Store Cards or NET30's

Fundability for fintech and alternative

$100,000

Broker Wholesale Price: $2,500

(Usual Tradeline Price: $3,000)

(Discounted by: $500)

Great For...

Approved $50K–$150K business credit cards & lines

No-PG equipment financing & MCA's

SBA Microloans or working capital lines

Business vehicle leases and small truck

Multi-card funding stacks with major banks

$250,000

$4,500 Investment

(Original Price $5,000)

Great For...

Purchasing Heavy Equipment

Purchasing Franchises

Commercial Real Estate

Larger Business Lines of Credit

Larger Business Lines of Credit

$150,000

Broker Wholesale Price: $3,000

(Usual Tradeline Price: $4,000)

(Discounted by: $1,000)

Great For...

Approved for $100K+ business credit limits from banks & CU's

Corporate gas cards and fleet funding

Real estate investing or commercial buildout loans

Private lenders and venture-based funding sources

Multiple tradelines or split-limit approvals

$150,000

$3,000 Investment

(compare at $4,000)

Great For...

Fleet of Vehicles

Larger Business Loans

Larger Business Lines of Credit

Residential Purchases

Investment Opportunities

$250,000

Broker Wholesale Price: $5,000

(Usual Tradeline Price: $6,000)

(Discounted by: $1,000)

Great For...

Positioned for $150K–$300K in total business credit approvals

Secured lines of credit and high-limit loans

Larger vehicle fleets, inventory financing, or marketing capital

Bank statement loans and business term loans

Funding ready" to institutional lenders

$500,000

Broker Wholesale Price: $8,000

(Usual Tradeline Price: $10,000)

(Discounted by: $2,000)

Great For...

Approved for $250K+ in funding through multiple sources

High-limit business charge cards and unsecured LOCs

Commercial real estate, buildout, or franchise financing

Bank-level underwriting and private capital partners

Multi-million dollar lender relationships and scaling capital

INTRODUCING our new...

Personal Primary Tradeline Offers

Here's what we're offering:

Revolving Tradelines

Auto Tradelines

Installment Tradelines

Manufactured Home / Real Estate Tradelines

Why Choose The Bradford Method As Your Business Credit Consultants and Business Funding Experts...

We are THE go-to Experts in the Business Credit, Funding & Financing Industries for HIGH-LIMIT Business Funding

We 've been successful for over 25 years with helping Entrepreneurs establish a BUSINESS CREDIT & FUNDING BLUEPRINT , that can be executed with ease, and in a short amount of time

Our Business Credit Building and Funding methods, help to increase YOUR odds of getting approved for higher limits, by establishing HIGH-IMPACT Business Credit

Our clients have gotten approved for over 16 million in Vehicle Loans, Business Loans, Business Credit Cards and Business Credit and Financing

100%

Guaranteed

Results

INTRODUCING Our...

Permanent PERSONAL Primary Tradelines

All PERSONAL Primary Tradeline Orders Are A ONE-TIME and Must Be Paid Upfront

Reports to: Equifax and Experian

Reports within 30-45 Business Days

Auto Tradelines:

Backdated: 4 Years

$50,000 Tradeline: $1,500

$75,000 Tradeline: $2,250

$10,000 Tradeline: $3,000

Credit Card Tradelines:

Backdated: 2 Years w/ 10% DTC

$10,000 Tradeline: $500

$15,000 Tradeline: $750

$25,000 Tradeline: $1,250

Auto Tradelines:

BACKDATED: 3-6 YEARS

$50,000 Tradeline: $1,750

$75,000 Tradeline: $2,500

$100,000 Tradeline: $4,000

Credit Card Tradelines:

BACKDATED: 3-6 YEARS

$10,000 Tradeline: $1,000

$15,000 Tradeline: $1,500

$25,000 Tradeline: $2,500

Installment Tradelines:

BACKDATED: 3-6 YEARS

$10,000 Tradeline: $1,000

$15,000 Tradeline: $1,500

$25,000 Tradeline: $2,500

INTRODUCING

PERSONAL Primary Tradelines

All PERSONAL Primary Tradeline Orders Are A ONE-TIME Payment and Must Be Paid Upfront

(NO CPN'S ACCEPTED)

Tradelines Report to: Equifax ONLY (will not have Experian & Transunion)

REVOLVING TRADELINES

Backdated

3 YEARS

DEADLINE(S): New Dates Coming Soon

$15,000

$25,000

$35,000

Report Open w/$0 balance

AUTO TRADELINES

Backdated

3 YEARS

DEADLINE(S): New Dates Coming Soon

$25,000

$50,000

$75,000

$100,000

$120,000

Reports as Open Accounts

with only 3 payments remaining

REAL ESTATE / MANUFACTURED TRADELINES

Backdated

3 YEARS

DEADLINE(S): New Dates Coming Soon

$100,000

$200,000

$250,000

Reports as Open Accounts

with only 3 payments remaining

INSTALLMENT TRADELINES

Backdated

3 YEARS

DEADLINE(S): New Dates Coming Soon

$25,000

$30,000

$50,000

$75,000

$100,000

$120,000

Reports as Open Accounts

with only 3 payments remaining

When you enroll to start offering Personal Primary Tradelines to new or existing clients, you’ll be positioned to help individuals overcome one of the biggest challenges in today’s credit market — building strong, legitimate personal credit profiles that lead to high-limit approvals

We understand how frustrating it can be for your clients to try and get approved for credit cards, personal loans, vehicle financing, or even mortgages when they don’t have the right credit foundation.

As a Broker with The Bradford Method , we provide access to Personal Primary Tradelines (Credit Card and Auto) that are designed to help your clients strengthen their personal credit profiles and increase their chances of approval.

It’s up to you, as the broker, to review your client’s needs and determine which tradeline options best align with their credit goals.

Our role is to supply the tradelines — giving you the opportunity to offer high-impact solutions that help clients build stronger credit foundations

.

Offering Personal Primary Tradelines with The Bradford Method gives you the tools and support to serve your clients better — while creating a new income stream and growing your own business in the process

BILL BRADFORD - THE BRADFORD METHOD

INTRODUCING

TBM 30-DAY CREDIT SWEEP

Core Credit Fix

Wipe Out Inaccuracies & Negative Marks Fast —

A Clean Slate in Just 30 Days

100% risk free - We work until your file is complete

Here's what you get:

Fast Results with Ongoing Support

Permanent Removal of Negative Accounts

Full Credit Profile Cleanup

Funding-Ready Credit Profile

Credit Sweep (1–5 Items) – $1,000

Credit Sweep (6+ Items) – $1,500

Primary Business Tradelines – The Trusted Resource Your Clients Need

As a Business owner... I understand the time and patience it takes when trying to obtain HIGH-LIMIT Business Financing... in order to get approved for Business Loans, Business Lines of Credit, Vehicle Financing or Trade and Vendor Credit...

As a broker, you’re working with business owners who are tired of getting denied for the funding they need to grow. The truth is, many of them are missing one key piece — strong, reportable business credit. That’s where our Primary Business Tradelines come in.

These tradelines post directly to the client’s business credit profile and help showcase comparable credit, which lenders look for when deciding who qualifies for higher-limit approvals. By offering this service, you become the solution your clients have been searching for — helping them build credibility, boost scores, and finally position their business for real funding opportunities.

Give your clients the competitive edge while creating a new stream of income for yourself with every order.

BILL BRADFORD - THE BRADFORD METHOD

OUR SUCCESSFUL BUSINESS CREDIT BUILDING CLIENTS

Sandra L, 28

Logistics Owner

My husband and I have owned a trucking business for over 5 years. We wanted to expand our business, and get more trucks on the road, but hadn't been able to get approved for any financing, because we only had a few business tradelines reporting. It wasn't until we heard about T.B.M., that we contacted them, and they helped us with adding Business Tradelines in a short period of time. After that we were approved for vehicle financing, a few business loans, and lines of credit to have an entire fleet of trucks, that travel nationwide

David O, 45

PROJECT MANAGER

"I've been in real estate for years, but I always hit a wall when it came to expanding my portfolio. Banks would look at my business credit and offer peanuts, forcing me to dip into personal savings or miss out on golden opportunities. Then I discovered [Your Company Name]'s primary business tradelines, and it was like someone flipped a switch.

Within months of adding one of their tradelines, I applied for funding and nearly fell out of my chair when I saw the approval amount. It was more than triple what I used to qualify for!

Tony W., 39

LAWNCARE BUSINESS OWNER

“I wanted to start my lawn service business with both of sons, but I was having trouble getting approved for financing. After being turned down by a bunch of banks, I learned that they were checking my business credit reports, and that I didn't have enough business credit. A month later I found out about The Bradford Method, and they helped me with adding Primary Business Tradelines to my business profile. They posted fast and the process was very easy! Now I am able to get equipment, hire other employees, and can expand my business further"

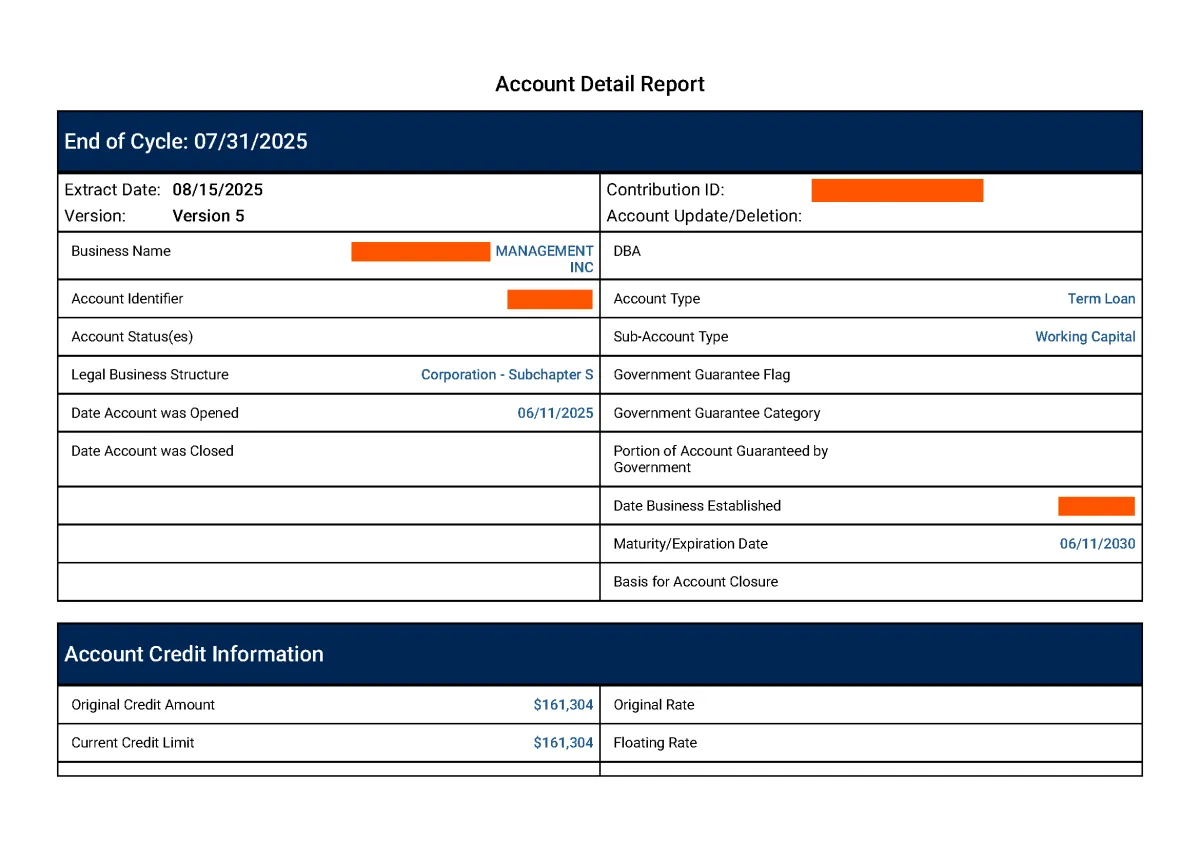

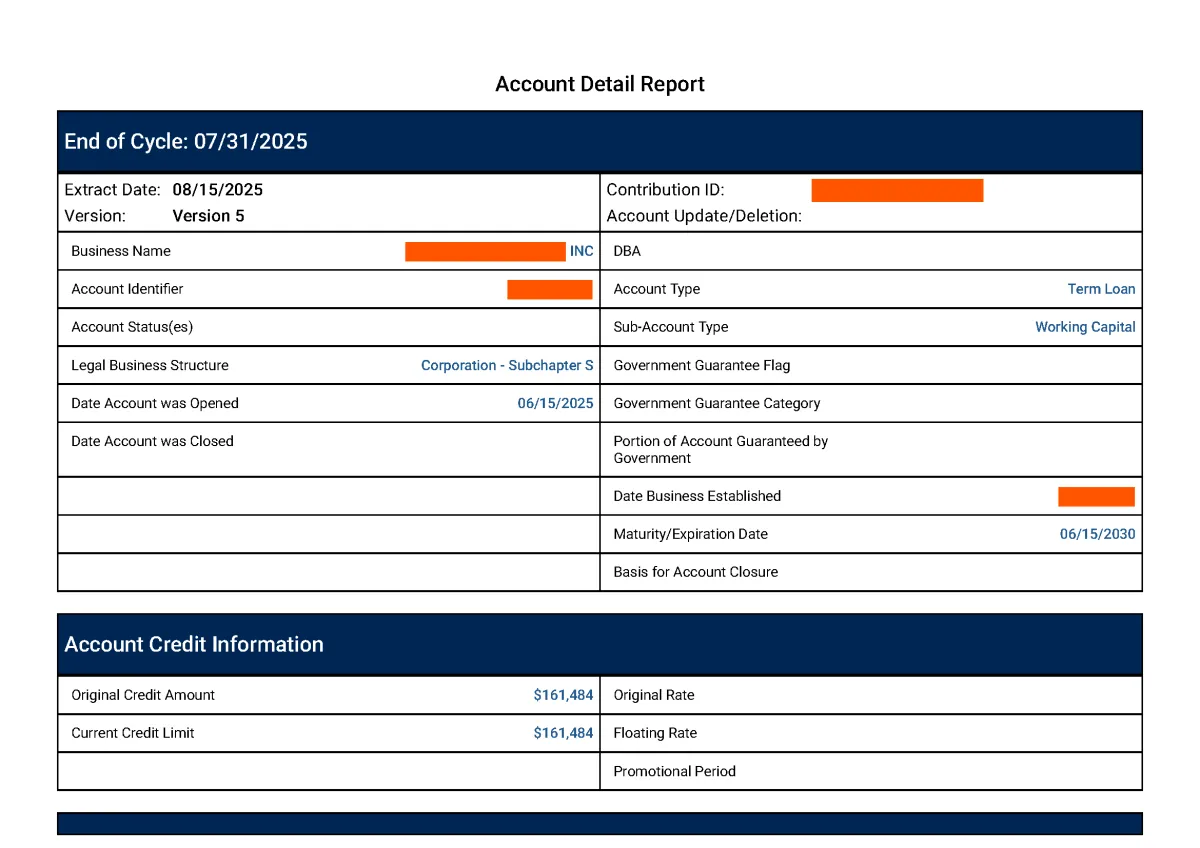

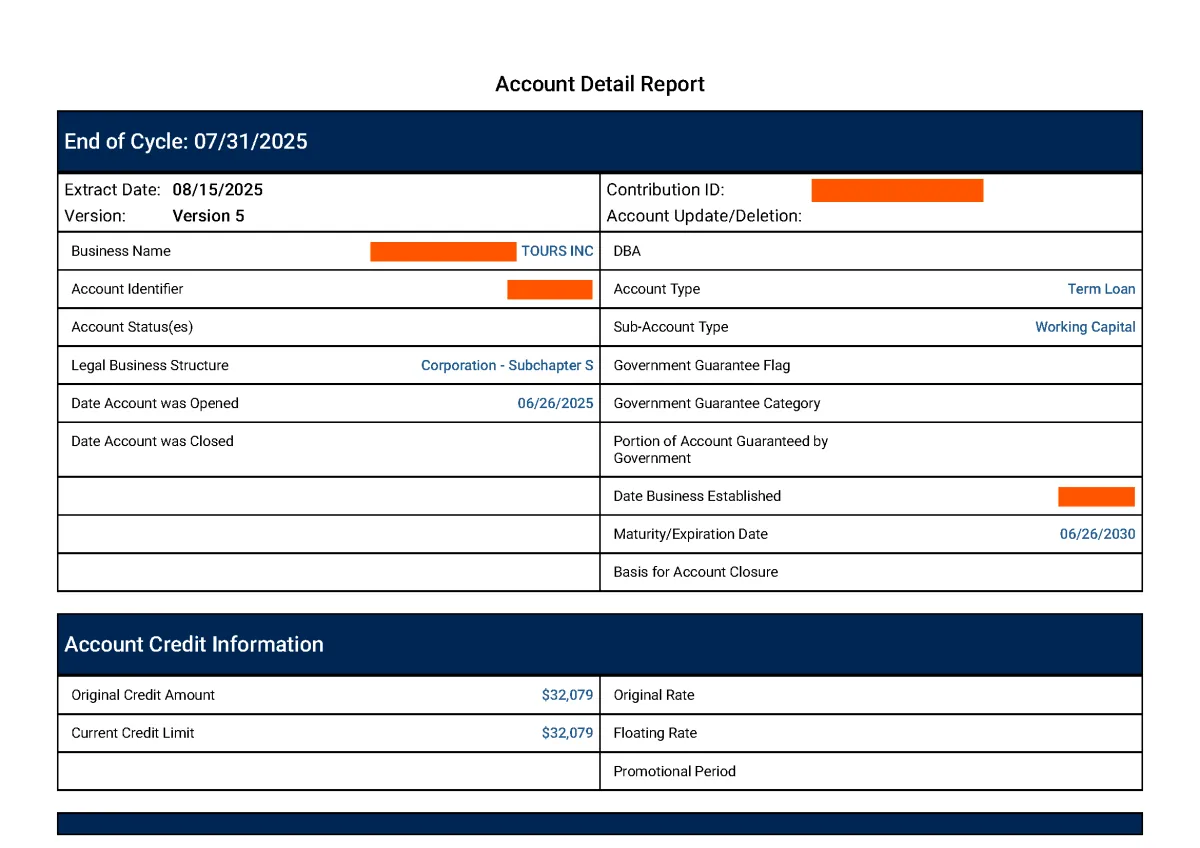

OUR RECENT SUCCESSFUL TRADELINE POSTINGS

Frequently Asked Questions

How do I start submitting clients for Tradelines?

To start submitting clients for Tradelines, we will need the following information: Payment from you as the broker and the TBM client tradeline application form. On the business tradelilne application we need: EIN Number, Experian BIN#, and Corporate ID/Document Number, client and business profile information.

Do I get a commision from TBM for submitting Tradeline orders?

At The Bradford Method, we DO NOT provide commission. As an Exclusive Broker, you recceive wholesale pricing. Anything the broker decides to charge above that, is at their discretion.

What Is Business Credit

Business tradelines establish permanent positive credit history to a business. Many companies rely on business credit to build the foundation of their business. Business tradelines provide the information banks use to determine whether or not to lend and how much.

Is there a cost to enroll and start offering Primary Business Tradelines to my client

No, there is not cost to start offer TBM Primary Business Tradelines

What Are the Advantages of Adding Business Tradelines

Establishing positive business credit makes it much easier to get approval for a business loan, business vehicle loans or even an equipment line of credit. In addition, business tradelines can also help you get approved of larger amounts of funding. Potential lenders always request business credit reports in the same way they request personal credit reports

What Business Credit Bureaus Do the Tradelines Report To?

Our Primary Business Tradelines Report to S.B.F.E. (small business financial exchange) and Experian Business Commercial Credit. You can purchase reports from DnB, NAV and Equifax to see the Tradeline reporting.

When Does the Tradeline Post?

The Tradeline will post on your business credit profile within 30 BUSINESS days from the date your order was accepted.

Do You Offer Backdated Business Tradelines

No, we do not offer backdated tradelines. Our Primary Business Tradelines report as a new, open and active installment account to your business credit profile. We will establish successful monthly payments, on your behalf for up to 1 1/2 years.

Can I Purchase More Than One Tradeline at a Time?

Yes, you can which we will discuss further during your Tradeline Discovery Call, where we could possibly customize a Tradeline Package for you and your business.

How Will I Know My Tradeline Has Posted?

Once your Tradeline has posted, we will provide you with a copy of the S.B.F.E business report. You will also be provided with a link to Experian Business Credit Reports, where you can order an additional business credit report for $49.99

How Will My Primary Business Tradeline Report?

Your Primary Business Tradeline will report as a new, open and active account that reports to your business credit profile permanently

Will Tradelines Guarantee Me Funding?

We are not able to guarantee funding for you or your company because you have added a Primary Business Tradeline. Our Tradelines are customized to assist you and your business with getting approved for higher limits and better rates... showing credibility to banks and lenders. We always recommend you have one of the 3 "C's" of Cash-flow, Collateral or Credit as well, which will make your journey to obtaining financing much smoother.

Will Having a Balance Reporting on My Business Profile Keep Me from Getting Funding?

When we post the Tradeline to your business profile, there will be one payment already applied to the balance. Over a period of 90 days, we will pay down the balance by 75%. The remaining balance will be paid off over a period of 1 1/2 years.

Do You Offer Business Funding Assistance?

We provide Business Funding Resources, to help steer your clients in the right direction for high limit funding. For more info, visit https://www.thebradfordmethod.com/tbmtlaffiliate

© 2025, The Bradford Method . All rights reserved.