Thanks For Being A Loyal Business Tradeline Broker

with The Bradford Method

Below, you will find all of the necessary information to start processing Tradelines for your clients

Primary Business Tradeline Information

Tradeline Post Info:

Entity Must Be Active And In Good Standing

With The Secretary of State

& Must Be 7 Months or Older

All Tradelines Report To...

S.B.F.E., and Experian Business

Tradeline Posting: Within 15-30 Business Days

Step 1: Review the TBM Resource & Tradeline Offers

Become A Broker w/ TBM

TBM Affiliate Broker Agreement

Client Intake Form

TBM Resource Bundle

Review Tradeline Offers

Step 2: Review required info & purchase tradeline

Steps to Submitting Clients

Purchase Client's Tradeline

Step 3: Order Experian report & submit client application

Experian Business Credit Report / BIN#

Client Business Tradeline Application

Client PERSONAL Tradeline Application

Client Intake Form

Payment Submissions

(only accept Zelle or Cash App)

Client Intake Form

Custom Primary Business Tradelines

*All Primary Business Tradelines MUST Be Paid Before The Tradelines Posts*

OPTION 7

$250k Line of Credit

250K S.B.F.E. Financial Line

250K Experian Financial Line

250K Equifax Financial Line

250K LexisNexis Financial Line

Upfront Price: $6,500

OPTION 8

$500K Line of Credit

500K S.B.F.E. Financial Line

500K Experian Financial Line

500K Equifax Financial Line

500K LexisNexis Financial Line

Upfront Price: $10,000

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

Have Questions? Schedule A Call Below To Speak With An Advisor

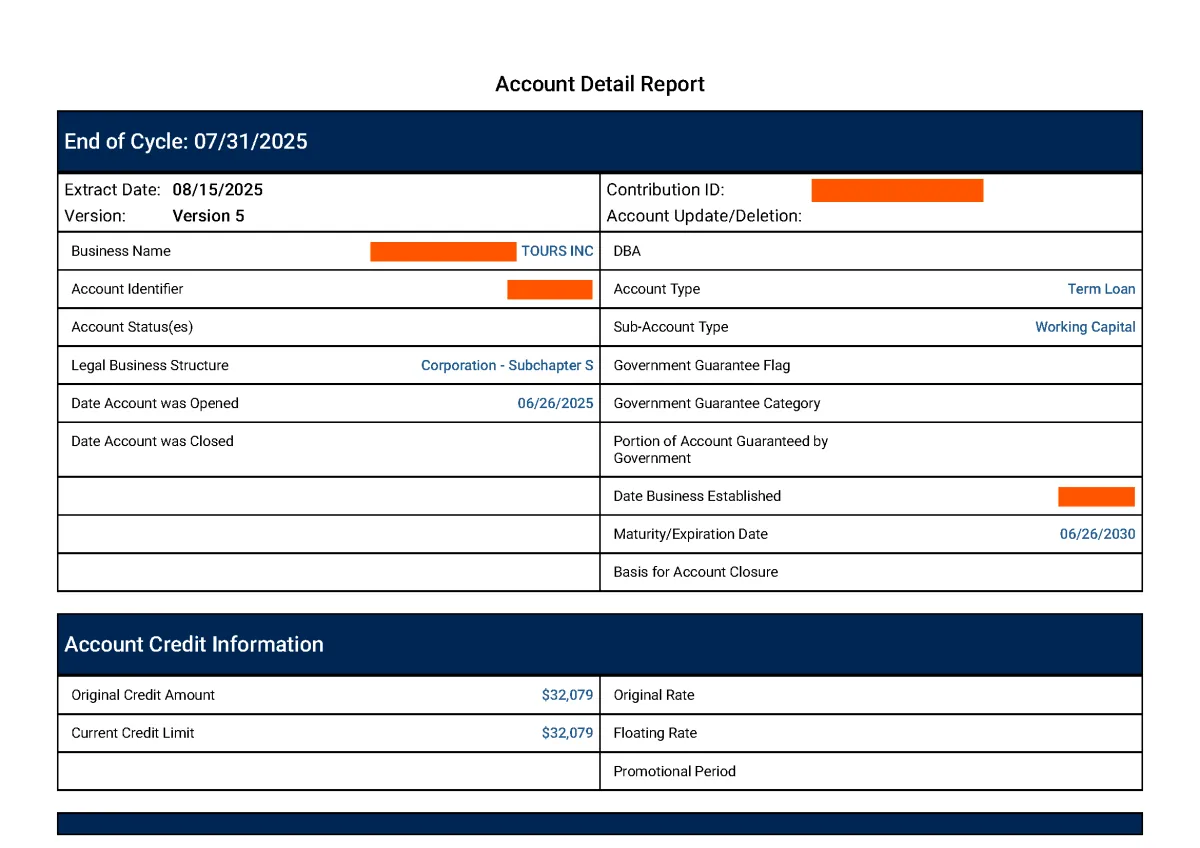

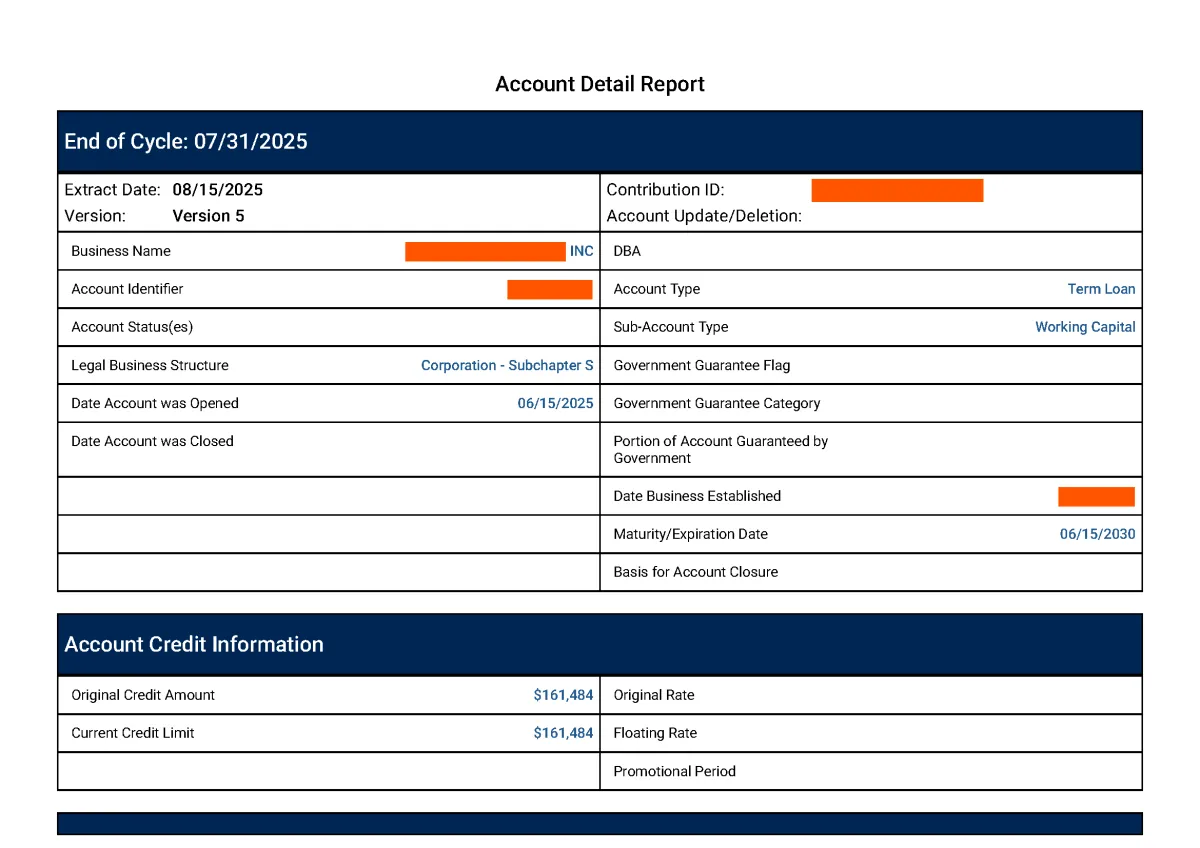

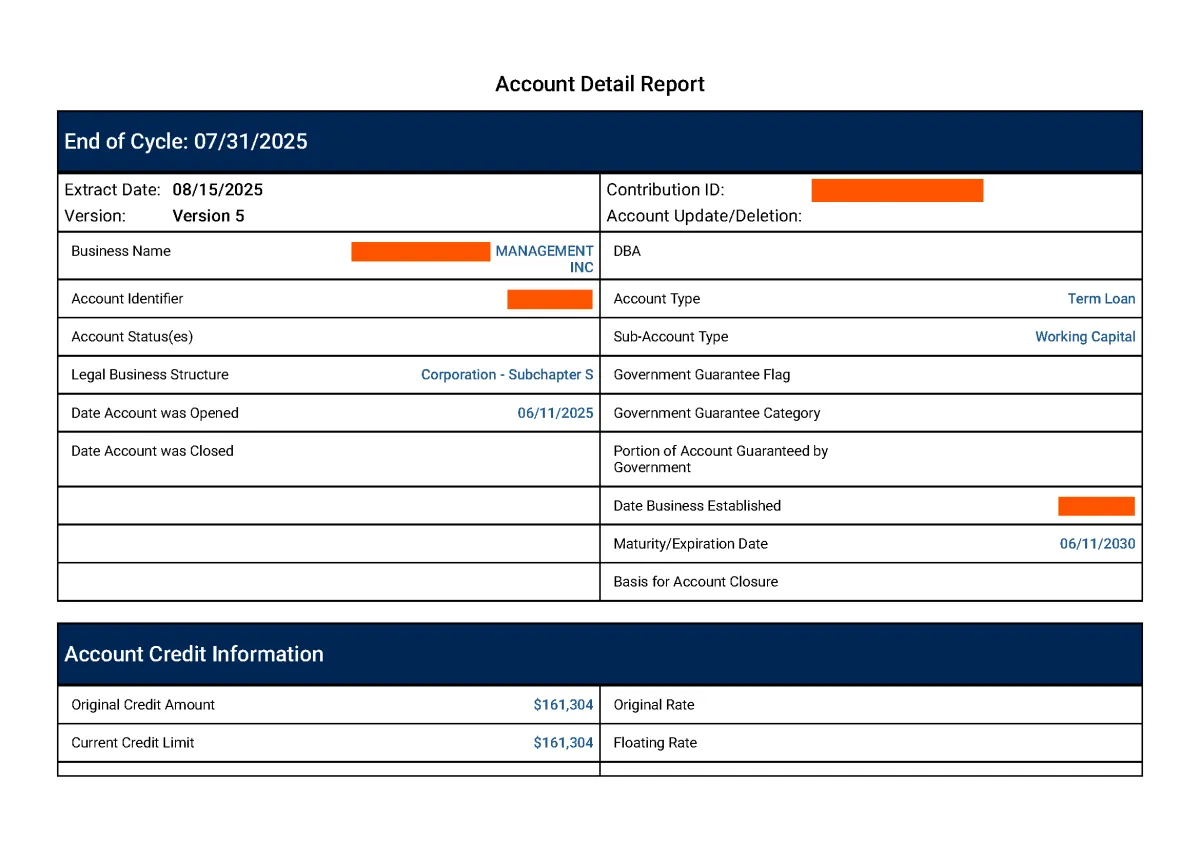

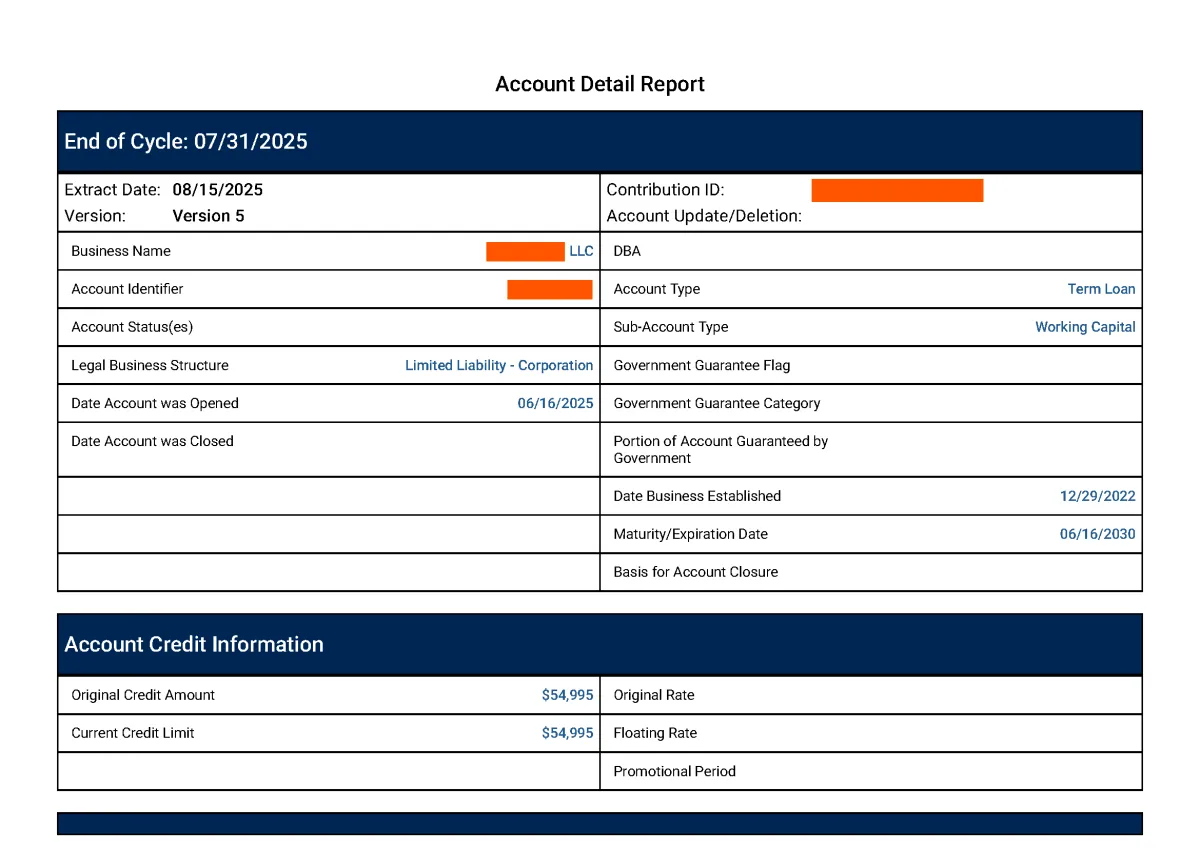

OUR RECENT SUCCESSFUL TRADELINE POSTINGS

OUR SUCCESSFUL BUSINESS CREDIT BUILDING CLIENTS

Sandra L, 28

Logistics Owner

My husband and I have owned a trucking business for over 5 years. We wanted to expand our business, and get more trucks on the road, but hadn't been able to get approved for any financing, because we only had a few business tradelines reporting. It wasn't until we heard about T.B.M., that we contacted them, and they helped us with adding Business Tradelines in a short period of time. After that we were approved for vehicle financing, a few business loans, and lines of credit to have an entire fleet of trucks, that travel nationwide

David O, 45

PROJECT MANAGER

"I've been in real estate for years, but I always hit a wall when it came to expanding my portfolio. Banks would look at my business credit and offer peanuts, forcing me to dip into personal savings or miss out on golden opportunities. Then I discovered [Your Company Name]'s primary business tradelines, and it was like someone flipped a switch.

Within months of adding one of their tradelines, I applied for funding and nearly fell out of my chair when I saw the approval amount. It was more than triple what I used to qualify for!

Tony W., 39

LAWNCARE BUSINESS OWNER

“I wanted to start my lawn service business with both of sons, but I was having trouble getting approved for financing. After being turned down by a bunch of banks, I learned that they were checking my business credit reports, and that I didn't have enough business credit. A month later I found out about The Bradford Method, and they helped me with adding Primary Business Tradelines to my business profile. They posted fast and the process was very easy! Now I am able to get equipment, hire other employees, and can expand my business further"

Frequently Asked Questions

What Is Business Credit

Business tradelines establish permanent positive credit history to a business. Many companies rely on business credit to build the foundation of their business. Business tradelines provide the information banks use to determine whether or not to lend and how much.

How do I start submitting clients for Tradelines

As an exclusive broker with The Bradford Method, you will need to collect payment from your clients, and submit payment to TBM. Once payment has been submitted, you will need to obtain the EIN number, the Corporate ID#/ Document # (located on the Articles of Organization, and an Experian BIN# , and the TBM Business Tradeline Application form.

Do I earn a commmission from TBM for submitting Tradeline orders?

At TBM we DO NOT offer commissions. The exclusive Broker pricing you receive is a set price. Anything you charge above that, is at your discretion.

What Are the Advantages of Adding Business Tradelines

Establishing positive business credit makes it much easier to get approval for a business loan, business vehicle loans or even an equipment line of credit. In addition, business tradelines can also help you get approved of larger amounts of funding. Potential lenders always request business credit reports in the same way they request personal credit reports

What Business Credit Bureaus Do the Tradelines Report To?

Our Primary Business Tradelines Report to S.B.F.E. (small business financial exchange) and Experian Business Commercial Credit. You can purchase reports from DnB, NAV and Equifax to see the Tradeline reporting.

When Does the Tradeline Post?

The Tradeline will post on your business credit profile within 30 BUSINESS days from the date your order was accepted.

Do You Offer Backdated Business Tradelines

No, we do not offer backdated tradelines. Our Primary Business Tradelines report as a new, open and active installment account to your business credit profile. We will establish successful monthly payments, on your behalf for up to 1 1/2 years.

Can I Purchase More Than One Tradeline at a Time?

Yes, you can which we will discuss further during your Tradeline Discovery Call, where we could possibly customize a Tradeline Package for you and your business.

How Will I Know My Tradeline Has Posted?

Once your Tradeline has posted, we will provide you with a copy of the S.B.F.E business report. You will also be provided with a link to Experian Business Credit Reports, where you can order an additional business credit report for $49.99

How Will My Primary Business Tradeline Report?

Your Primary Business Tradeline will report as a new, open and active account that reports to your business credit profile permanently

Will Tradelines Guarantee Me Funding?

We are not able to guarantee funding for you or your company because you have added a Primary Business Tradeline. Our Tradelines are customized to assist you and your business with getting approved for higher limits and better rates... showing credibility to banks and lenders. We always recommend you have one of the 3 "C's" of Cash-flow, Collateral or Credit as well, which will make your journey to obtaining financing much smoother.

Will Having a Balance Reporting on My Business Profile Keep Me from Getting Funding?

When we post the Tradeline to your business profile, there will be one payment already applied to the balance. Over a period of 90 days, we will pay down the balance by 75%. The remaining balance will be paid off over a period of 1 1/2 years.

Do You Offer Business Funding Assistance?

Yes, we provide Business Funding Assistance, however, because we customize each Business Owners Funding Blueprint, details can only be discussed during a Tradeline Discovery Call.

Do You Offer Any Other Business Services

Yes, we offer other TBM Business Services and Resources, however, they will only be discussed during your Tradeline Discover Call.

START BUILDING BUSINESS CREDIT

Your Success

in Business is Our

Business

Having access to money and credit for your business ultimately

determines your business’s success or failure, per the SBA. But

unfortunately, according to Enterprenuer.com, 90% of business

owners know nothing about business credit, and ironically

about 90% of businesses in the United States that open will end

up failing and closing their doors for good.

"The 5 C's of Business Credit...Character, Capital, Capacity, Collateral and Conditions"

BILL BRADFORD, THE BRADFORD METHOD -TRADELINE ADVISOR

Having a good business credit profile and score can mean

the difference between you having a prosperous business, or

helming a sinking ship. You need money and credit to grow,

especially to grow into a highly successful business. This is

actually one commonality all successful business have: they all

have established business credit.

Bill Bradford here, along with Maisha, my wife and business partner of 20 years. Both Maisha and I are from Las Vegas, NV with experience in

Business Credit and Funding.

We offer primary business tradeline packages that report to the three major business credit bureaus; Experian, Equifax & Small Business Financial Exchange (SBFE).

Adding business tradelines is like adding authorized user tradelines except that they are attached to a business credit file.

THE FUNDING BLUEPRINT FOR ENTREPRENEURS

Find Out What's On Your Business Credit Reports...

DOWNLOAD NOW...

QUICk & EASY WAYS TO GET AN EXCELLENT BUSINESS CREIDT SCORE!

There are a ton of benefits that business credit provides,

including that a credit profile can be built for a business,

completely separate from the business owner’s personal credit

profile. This gives business owners double the borrowing power

as they can have both personal and business credit profiles.

Fico Scores Decoded

Obtain excellent personal credit scores fast and easy, regardless of personal credit now

Fico Scores Decoded

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam.

RECENT CASE STUDIES

Our Latest Success Stories

Business Credit Articles

Dun & Bradstreet / Paydex Score

HAPPY CLIENTS

3 Business Credit Myths

PROJECTS FINISHED

WHY WE'RE THE BEST...

Our tradelines never close, fall off or disappear.

CHOOSE YOUR PRICING PLAN

Basic

Monthly Package

$$$

Finance

Risk Management

Audit & Accounting

Marketing

Advanced

Monthly Package

$$$

Business Plan

Marketing Research

Expenses Analysis

Strategy Ideas

Deluxe

Monthly Package

$$$

Business Consulting

Marketing Plan and Strategy

Audit & Accounting

Law Assistance

OUR TEAM

Meet Your Business Credit Advisors

John Doe

John Doe

John Doe

Frequently Ask Question

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

Get In Touch

Email: [email protected]

Address

Office: Las Vegas, NV

Assistance Hours

Mon – Fri 8:00am – 5:00pm

Sunday – CLOSED